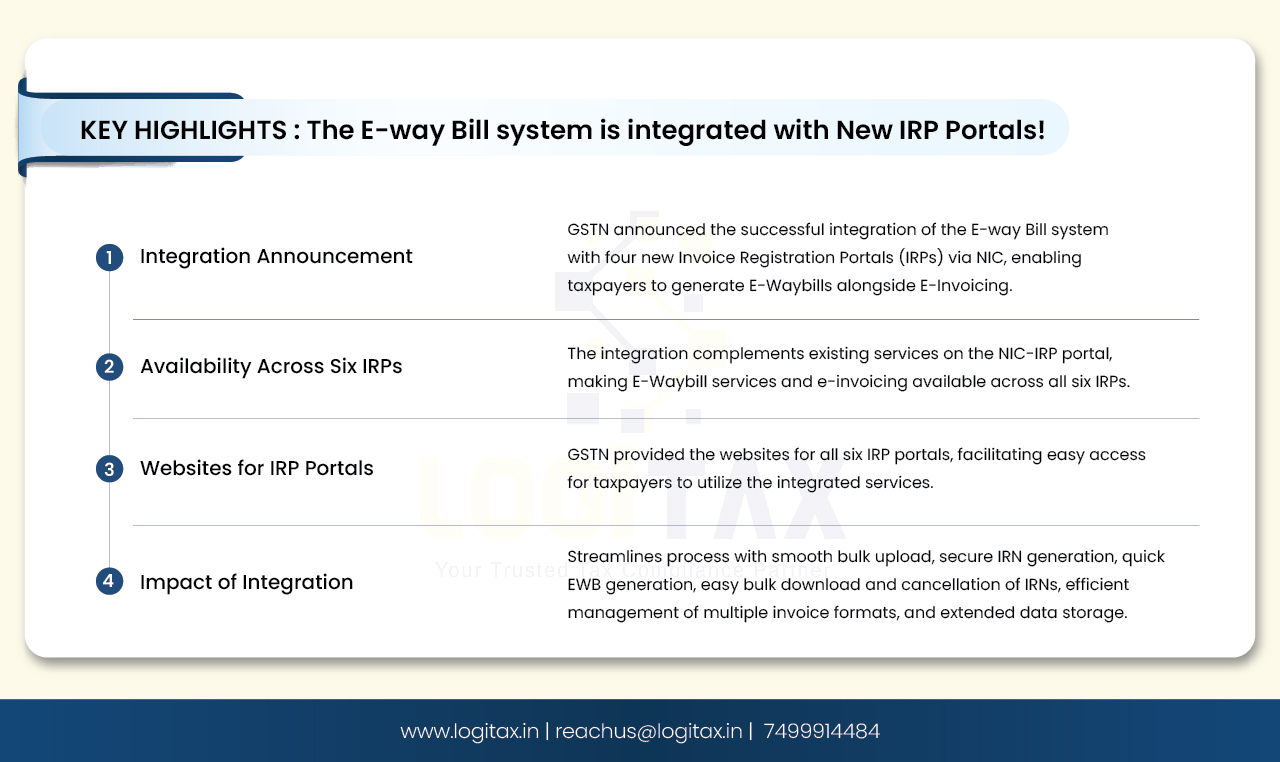

GSTN issued an advisory on the 08th of March, 2024 announcing the successful integration of the E-way Bill system with the new e-invoice Registration Portal (IRP). 6 websites are mentioned in the advisory for the IRP portals.

Let's understand this advisory!

Following is the text of the advisory:

“Advisory: Integration of E-Waybill system with New IRP Portals

08/03/2024

Dear Taxpayers,

Thank You,

Team GSTN”

As the E-way bill system is integrated with new IRP portals, it will be easier for taxpayers to prepare e-way bills and e-invoices on the same platform. The following are the key benefits of the integration:

The Invoice Registration Portals (IRPs) function as Registrars, utilizing a web-based platform to allocate Invoice Reference Numbers (IRNs) to every invoice, credit note, or debit note. Users can enter invoice/credit-debit note details onto the IRP through a specified method, enabling the system to generate or validate the IRN within a defined timeline, if applicable.

Connecting the E-way bill system with the IRP portal will ensure that data flows smoothly between these two important documents. This teamwork will make it easier for taxpayers, helping them quickly and completely follow the rules. It also reduces the time and work needed to enter the same information in different systems.

e invoicing and e way bill

e invoice and e way bill

is e way bill mandatory for e invoice

e-way bill, eway

e way bill generation

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More