As per section 50(1) of the CGST Act, 2017, every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding 18%, as may be notified by the Government on the recommendations of the Council.

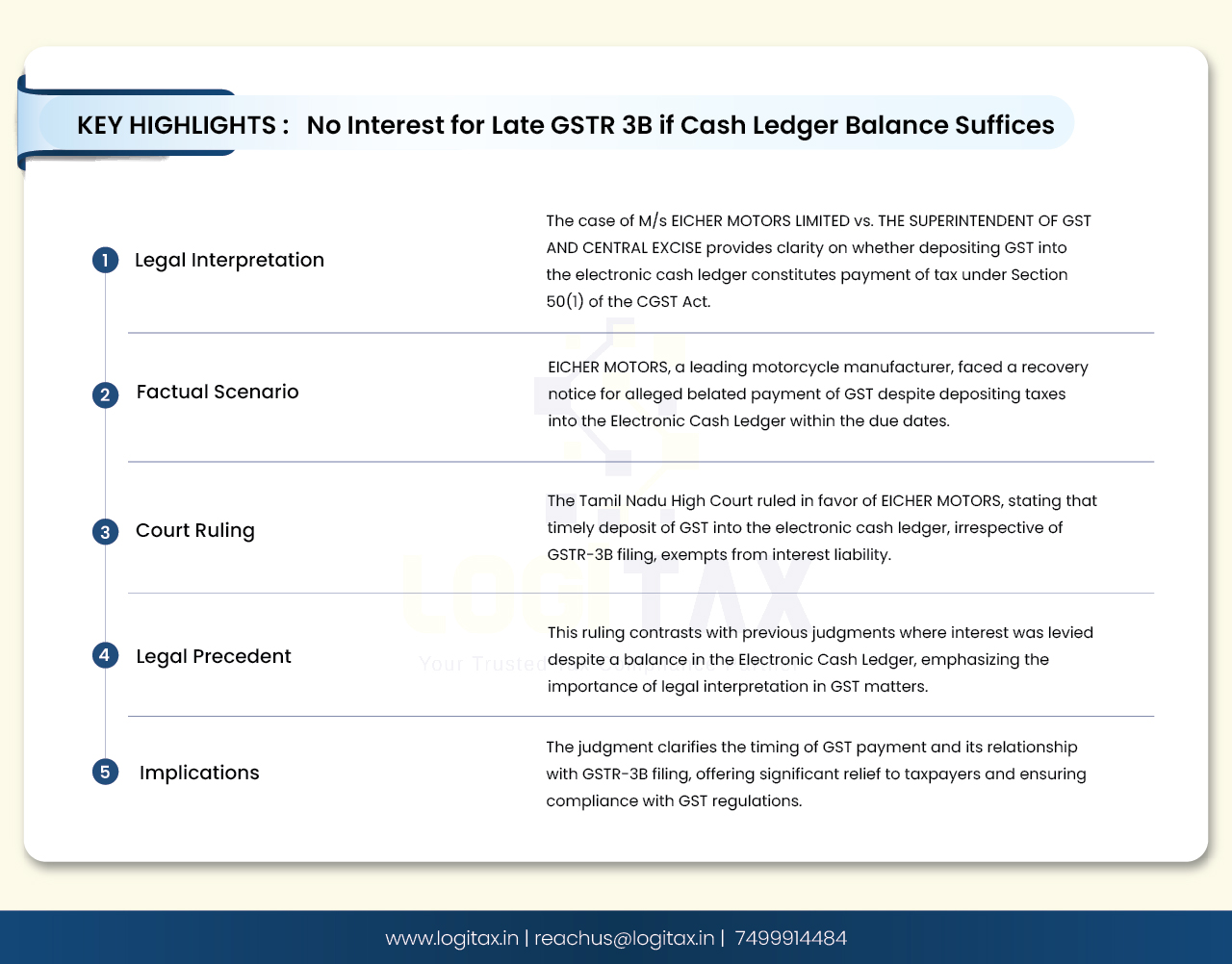

The confusion is whether payment of GST by depositing the amount in the electronic cash ledger is considered as payment of tax for the above section. This confusion is cleared by the case law of M/s EICHER MOTORS LIMITED vs. THE SUPERINTENDENT OF GST AND CENTRAL EXCISE decided in Tamil Nadu High Court dated 23rd January 2024.

Facts of the case:

The petitioner is a renowned manufacturer of mid-sized motorcycles led by the iconic brand Royal Enfield, with its manufacturing unit in Tamil Nadu.

They had an accumulated balance of a sum of Rs.33,87,10,445/- as CENVAT credit ready to be transitioned into the GST regime on 01.07.2017. However, owing to the need for system readiness and technical glitches in the GST Common Portal during the initial stages of implementation of GST, the Department had extended the due dates for filing Form GST TRAN-1 from time to time. Accordingly, the petitioner filed their Form GST TRAN 1 on 16.10.2017.

Due to unknown reasons, the credit did not reflect in the Electronic Credit Ledger, the petitioner could not file the monthly return in Form GSTR-3B for July 2017 within the due date i.e., 28.08.2023. Such non-filing of Form GSTR-3B for July 2017 had a domino effect and the petitioner was unable to file the GSTR-3B for subsequent months from August 2017 to December 2017, since Section 39(10) of the CGST Act disables an assessee from filing returns for the subsequent period if the returns for the previous tax period are not furnished.

Though the petitioner was disabled from filing the returns, the petitioner had ensured that the tax dues were fully paid within the due dates without any delay and accordingly, the petitioner had discharged GST liability for the period from July 2017 to December 2017 by depositing the tax amounts in the Electronic Cash Ledger under the appropriate heads as CGST, SGST, IGST into the Government account within the due date for each month.

The entire amount of accumulated credit was not transitioned and hence, the petitioner was constrained to file a revised GST TRAN-1 on 27.12.2017. On such filing, the aforesaid amount of transitioned credit was reflected in the petitioner's Electronic Credit Ledger, which enables the petitioner to file Form GSTR 3B for July 2017. Since the return for July 2017 was filed, the GST portal permitted the petitioner to file the returns for the subsequent months as well. Accordingly, the petitioner filed all the Returns from the month July 2017 to December 2017 on 24.01.2018.

After a lapse of around 6 years, the petitioner was visited with a Recovery notice dated 16.05.2023, demanding the payment of interest of a sum of Rs.23,76,26,657/- for the alleged belated payment of GST from July 2017 to December 2017.

The said recovery proceedings were initiated directly even without the issuance of show cause notice. Even after the filing of a detailed response by the petitioner, the Department did not withdraw the recovery proceedings and hence, the petitioner challenged the said Recovery notice in High Court. The court granted a stay of recovery proceedings subject to the payment of 30% of the interest amount demanded in the Letter dated 16.05.2023.

Aggrieved by the said interim order, the petitioner had preferred an appeal. In the said writ appeal, an order came to be passed on 20.06.2023, wherein the Hon'ble Division Bench of Court had directed the department to consider the petitioner's representation and pass an order within 3 weeks.

Under the said order dated 20.06.2023, the Department considered the petitioner's representation and passed an order dated 12.07.2023 confirming the demand of interest against the petitioner. Aggrieved over the said order dated 12.07.2023, the petitioner had filed this petition.

The common issue involved in both these writ petitions is whether the petitioner is liable to pay interest of the GST amount, which was routinely deposited into the ECL within the due date. However, the case of the Department is that the deposit of tax in an Electronic Cash Ledger would not amount to payment of tax and would be tantamount to failure to remit GST in time, for which interest liability would be attracted.

The High Court held that since the GST amount has been paid before the due date without any delay, no interest should be levied.

It stated that in the monthly returns in Form GSTR-3B, it is mandatory to provide the details about the tax paid, which means that before filing Form GSTR-3B, the tax should have been paid by the registered person as provided in Section 39(1) of the CGST Act. That is why details of the payment of tax are required to be furnished in Form GST PMT-06 irrespective of the time of filing the GSTR-3B, whether it is before or after the due date for filing the returns.

In terms of Section 39(7) of the CGST Act, the last date for payment of tax would be the date not later than the last date on which the registered person is required to furnish the monthly return. Thus, for payment of tax filing the monthly returns is not a matter but the last date for furnishing the monthly return is important. Further, Section 39(7) of the CGST Act states that the tax should have been paid to the Govt before the last date for filing the GSTR-3B Returns, which means the instance of payment of tax would occur not later than the last date of filing of GSTR-3B.

Thus, it is immaterial whether GSTR-3B is filed within the due date or not for remittance of tax to the account of the Government. Given the above, it is incorrect to state that the instance of payment of tax would occur only upon the filing of the GSTR-3B return and thereafter by debiting the electronic credit ledger or electronic cash ledger.

The assessees have been maintaining said ledgers, only for accounting, while, the entire tax is to be paid to the Government directly by using Form GST PMT-06 not later than the last date for filing Form GSTR-3B. Whenever the GST has been paid by using Form GST PMT-06, the tax liability will be discharged to that extent.

The filing of GSTR-3B ensures the complete discharge of GST liability by the registered person through the accounting entries in the respective ledgers, it does not mean that only when the GSTR-3B is filed, the Government can utilize the GST collection made by the registered person.

The submissions of Revenue that the GST can be paid only after filing the GSTR-3B, is against the provisions of Sections 39(1), 39(7), and Explanation (9) to Section 49(11) of the Act.

However, the Madras High Court in the case of M/s EICHER MOTORS LIMITED has held otherwise.

The High Court of Tamil Nadu mentioned in this case that it differs its views from the Judgement of the Jharkhand High Court rendered in the RSB Transmission case and the judgment rendered by the Telangana High Court in the Megha Engineering case and followed the law laid down by the Gujarat High Court in the Vishnu Aroma Pouching case.

It stated that for the payment of tax to the account of the Government, the filing of GSTR-3B is immaterial, which means either with or without the filing of monthly returns, the tax can be remitted to the Government. Therefore, no interpretation can be made as held in the judgment of the Hon'ble Division Bench of Jharkhand High Court rendered in the RSB Transmission case.

Stating that no payment of tax can be made until the filing of GSTR-3B, which is against the provisions of Section 39(1) and 39(7) of the Act and thus, the said finding would render disastrous consequences in the utilization of GST collections by the exchequers.

Merely, for the default on the part of a registered person in filing the GSTR-3B, the utilization of tax amount, which was already deposited into the account of the Government, cannot be postponed. Further, Section 50(1) of the CGST Act states that cash should have been paid to the Government within the prescribed period, which is the 20th day of every month in terms of Section 39(7) of the Act.

The said prescribed period is the only time limit provided under Section 50(1) of the Act. However, the said proviso was also interpreted otherwise in the judgment rendered in the RSB Transmission case by the Hon'ble Division Bench of the Jharkhand High Court, which is not permissible since the same is beyond the scope of the provision of Section 50(1) of the Act.

The law laid down by the Hon'ble Division Bench of the Jharkhand High Court in the RSB Transmission case and the judgment rendered by the Telangana High Court in the Megha Engineering case is not in line with the provisions of the Act and Rules made thereunder and hence, this Court is unable to follow the same. In the judgment of Vishnu Aroma Pouching Private Limited, the Gujarat High Court had taken a view, which is similar to the view of this Court.

While Section 50 of The CGST Act was retrospectively amended to provide that there would be no interest liability on delayed filing of GSTR-3B to the extent of balance in The Electronic Credit Ledger, the Courts in many cases had held that interest was payable even after there was balance in the Electronic Cash Ledger. Tamil Nadu High Court has confirmed that no interest is to be levied when the tax amount is deposited in the electronic cash ledger within the due date of filing GSTR 3B.

Electronic Cash Ledger

gstr-3b

cash ledger balance

Late filing penalty

GST compliance

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More