CBIC has issued 2 circulars on 31st October 2023 w.r.t. following issues based on the recommendation of the GST Council in its 52nd meeting held on 7th October 2023 :

Clarification regarding GST rate on imitation zari thread or yarn

Clarifications regarding the applicability of GST on certain services are as follows:

Passenger transport service and renting of motor vehicles

Reimbursement of electricity charges

Job work for processing of “Barley” into “Malted Barley”

DMFTs set up by the State Governments are Governmental Authorities

Horticulture/horticulture works

Let’s discuss these circulars in detail!

This circular provides Clarification regarding the GST rate on imitation zari thread or yarn. The GST Council in its 50th meeting had recommended a reduction of the GST rate to 5% on imitation zari thread or yarn, following which Sl. No. 218AA had been inserted in Schedule I of notification no. 1/2017- Central Tax (Rate) dated 28.6.2017. The doubt was whether metal-coated plastic film converted to metalized yarn and twisted with nylon, cotton, polyester, or any other yarn to make imitation zari thread is covered under Sl. No. 218AA of Schedule I attracting 5% GST.

It is clarified in this circular that imitation zari thread or yarn made from metalized polyester film/ plastic film falling under HS 5605 is covered by Sl. No. 218AA of Schedule I attracting 5% GST.

The GST Council has also recommended that no refund will be permitted on polyester film (metalized)/plastic film on account of the inversion of the tax rate.

Requisite changes have been made in notification no. 5/2017-Central Tax (Rate) vide Notification no 20/2023-Central Tax (Rate) dated 19.10.2023.

This circular provides clarification regarding the applicability of GST on certain services based on the recommendations of the GST Council in its 52nd meeting held on 7th October 2023.

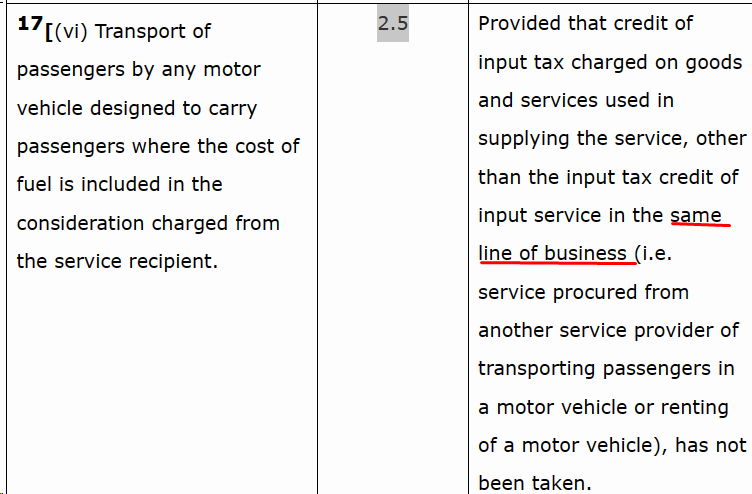

Whether ‘same line of business’ in the case of passenger transport service and renting of motor vehicles include leasing of motor vehicles without operators?

Services of transport of passengers by any motor vehicle (SAC 9964) and renting of a motor vehicle designed to carry passengers with the operator (SAC 9966), where the cost of fuel is included in the consideration charged from the service recipient attract GST at the rate of 5% with an input tax credit of services in the same line of business.

The same line of business as stated in notification No. 11/2017-Central Tax (Rate) means “service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle”.

It is clarified that input services in the same line of business include the transport of passengers (SAC 9964) or the renting of motor vehicles with operators (SAC 9966).

Leasing of motor vehicles without an operator (SAC 9973)is not included in “Input services in the same line of business” which attracts GST and/or compensation cess at the same rate as the supply of motor vehicles by way of sale.

Read more about Export of Services in our blog on GST Circulars dated 27-10-2023

Whether GST is applicable on reimbursement of electricity charges received by real estate companies, malls, airport operators etc. from their lessees/occupants?

It is clarified that whenever electricity is being supplied bundled with renting of immovable property and/or maintenance of premises, as the case may be, it forms a part of the composite supply and shall be taxed accordingly. The principal supply is renting of immovable property and/or maintenance of the premise, as the case may be, and the supply of electricity is an ancillary supply as the case may be.

Even if electricity is billed separately, the supplies will constitute a composite supply, and therefore, the rate of the principal supply i.e., GST rate on renting of immovable property and/or maintenance of premise, as the case may be, would be applicable.

However, where the electricity is supplied by the Real Estate Owners, Resident Welfare Associations (RWAs), Real Estate Developers, etc., as a pure agent, it will not form part of the value of their supply. Further, when they charge for electricity on an actual basis, that is, they charge the same amount for electricity from their lessees or occupants as charged by the State Electricity Boards or DISCOMs from them, they will be deemed to be acting as a pure agent for this supply.

Whether job work for processing of “Barley” into “Malted Barley” attract GST @ 5% as applicable to "job work in relation to food and food products” or 18% as applicable on “job work in relation to manufacture of alcoholic liquor for human consumption”?

Malt is a food product. It can be directly consumed as part of food preparations or can be used as an ingredient in food products and also used for the manufacture of beer and alcoholic liquor for human consumption. However, irrespective of end-use, the conversion of barley into malt amounts to job work in relation to food products.

Therefore, job work services in relation to the manufacture of malt are covered by the entry at Sl. No. 26 (i) (f) which covers “job work in relation to all food and food products falling under chapters 1 to 22 of the customs tariff” irrespective of the end use of that malt and attracts 5% GST.

Whether District Mineral Foundations Trusts (DMFTs) set up by the State Government are Governmental Authorities and thus eligible for the same exemptions from GST as available to any other Governmental Authority?

DMFTs work for the interest and benefit of persons and areas affected by mining-related operations by regulating receipt and expenditure from the respective Mineral Development Funds created in the concerned district. They provide services related to drinking water supply, environment protection, health care facilities, education, welfare of women and children, supply of medical equipment, etc.

These activities are similar to activities that are enlisted in the Eleventh Schedule and Twelfth Schedule of the Constitution. The ultimate users of the various schemes under DMF are individuals, families, women and children, farmers/producer groups, SHGs of the mining affected areas, etc. The services/supplies out of DMF funds are provided free of charge and no consideration is realized from the beneficiaries by DMF against such services.

Therefore, DMFTs set up by the State Governments are Governmental Authorities and thus eligible for the same exemptions from GST as available to any other Governmental Authority.

Whether the supply of pure services and composite supplies by way of horticulture/horticulture works (where the value of goods constitutes not more than 25 percent of the total value of supply) made to CPWD are eligible for exemption from GST under Sr. No. 3 and 3A of Notification no 12/2017-CTR dated 28.06.2017?

Public parks in government residential colonies, government offices, and other public areas are developed and maintained by CPWD.

Maintenance of community assets, urban forestry, protection of the environment, and promotion of ecological aspects are functions entrusted to Panchayats and Municipalities under Article 243G and 243W read with Sr. No. 29 of 11th Schedule and Sr. No. 8 of 12th Schedule of the constitution.

Sr. No. 3 and 3A of notification No. 12/2017-CTR exempt pure services and composite supply of goods and services in which the value of goods does not constitute more than 25%, that are provided to the Central Government, State Government or Union territory or local authority by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function entrusted to a Municipality under article 243W of the Constitution.

Therefore, the supply of pure services and composite supplies by way of horticulture/horticulture works (where the value of goods constitutes not more than 25 percent of the total value of supply) made to CPWD are eligible for exemption from GST under Sr. No. 3 and 3A of Notification no 12/2017-CTR dated 28.06.2017.

These circulars provide valuable clarity on the GST rate for imitation zari thread or yarn and the applicability of GST on services related to passenger transport, renting of motor vehicles, reimbursement of electricity charges, job work for processing barley into malted barley, DMFTs set up by state governments, and horticulture works. The guidance offered in these circulars ensures a better understanding of these GST-related matters, benefiting businesses and taxpayers across India.

Gst notifications

Cbic notification

Cbic hsn code

Gst

Latest notifications

Latest gst notification

Gst rates change

Council meeting

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More