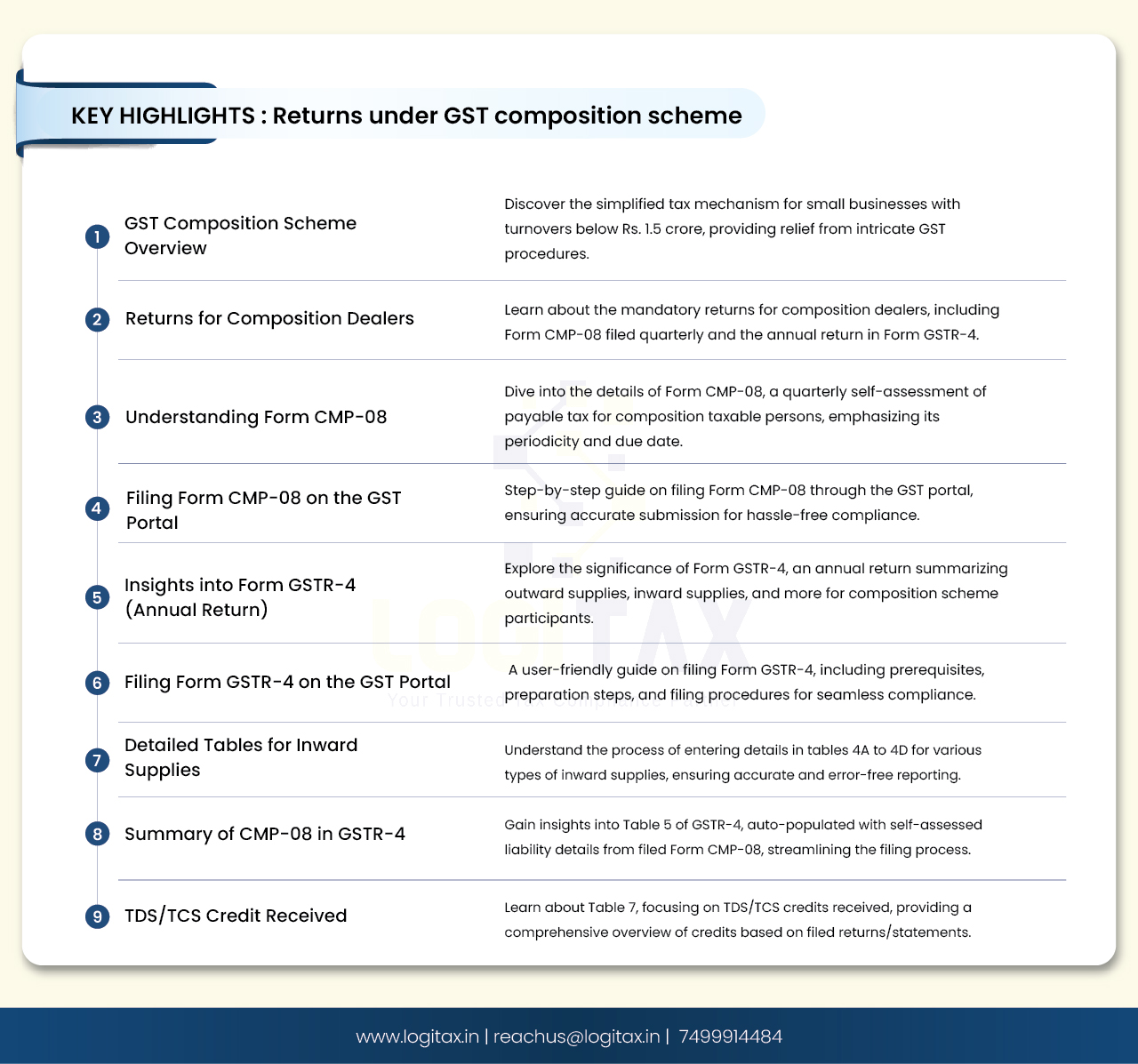

GST Composition Scheme is an easy mechanism for small taxpayers. The taxpayers can find escape from tedious GST formalities and pay GST at a fixed rate on turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.5 crore.

To know more about composition scheme, read on.

A composition dealer is required to file below returns:

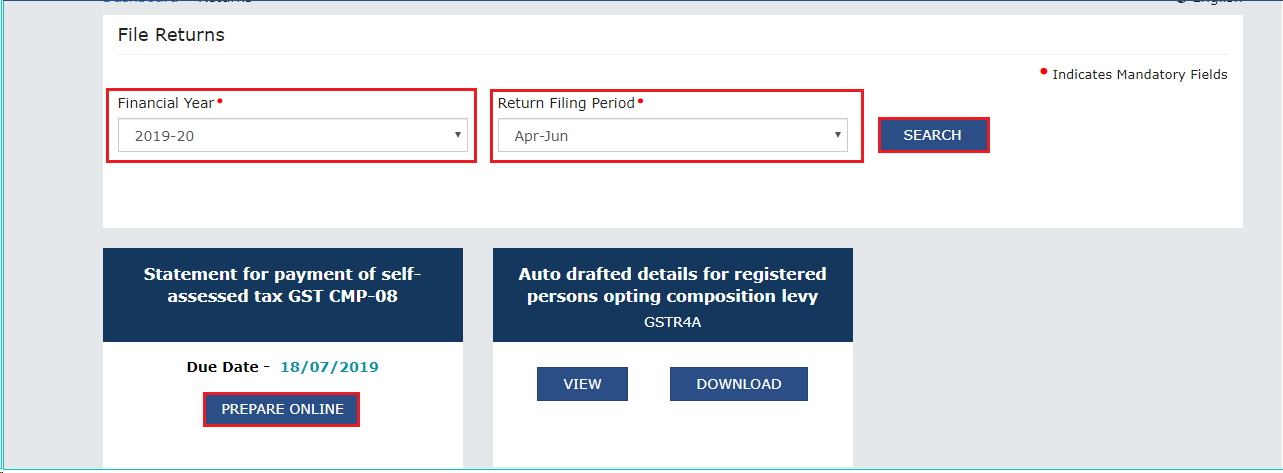

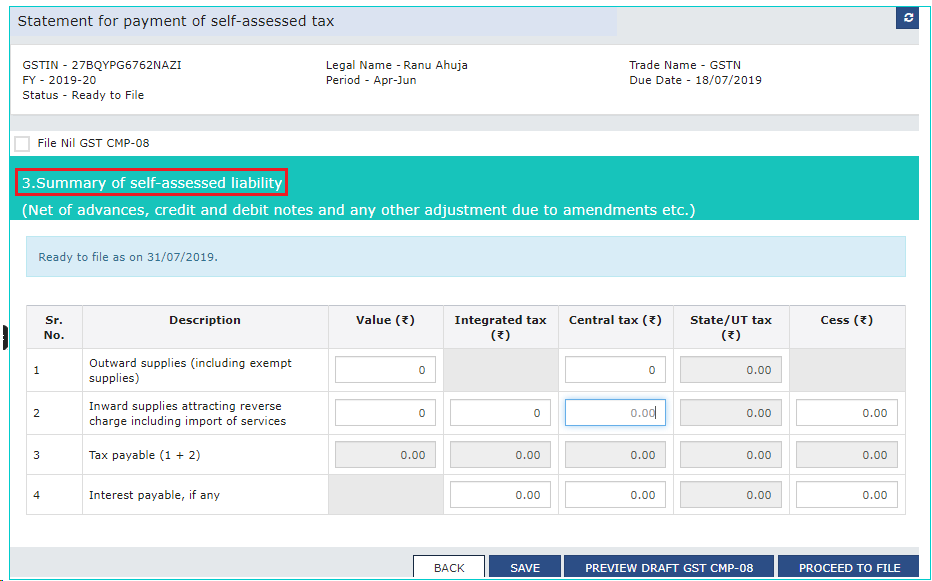

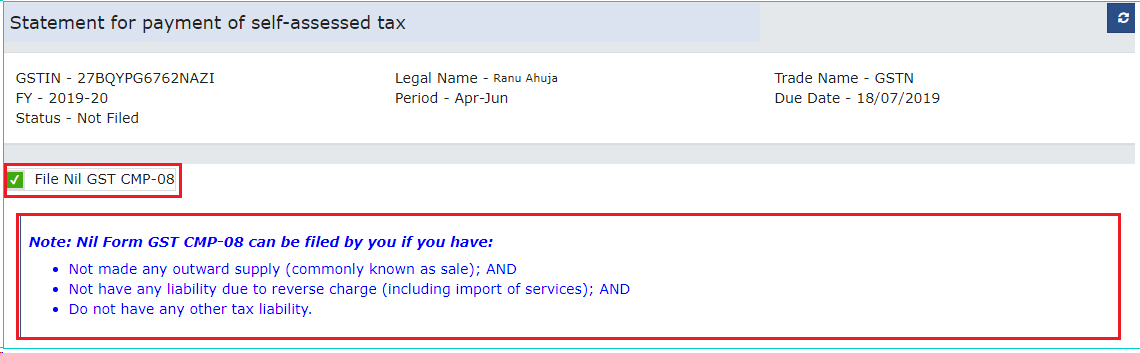

Form GST CMP-08 is used to declare the details or summary of self-assessed tax which is payable for a given quarter by taxpayers who are registered as composition taxable person or taxpayer who have opted for composition levy.

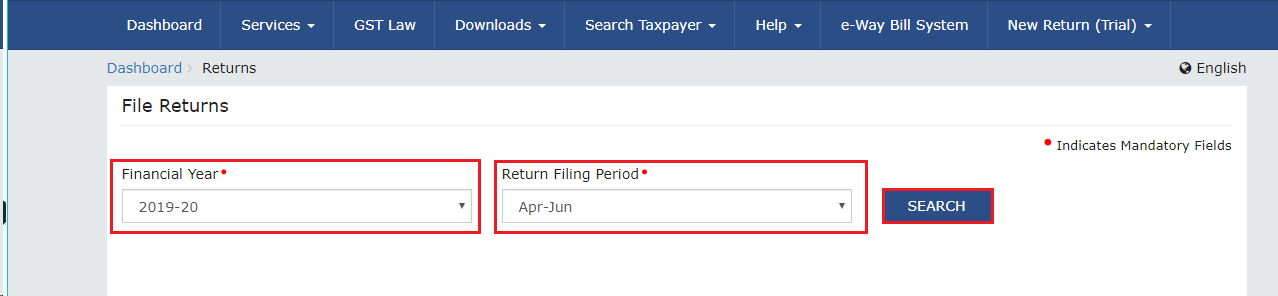

Form GST CMP-08 is to be filed on quarterly basis. The due date for filing Form GST CMP-08 is 18th of the month succeeding the quarter. Even if there is no tax liability in any quarter, nil CMP-08 has to be filed.

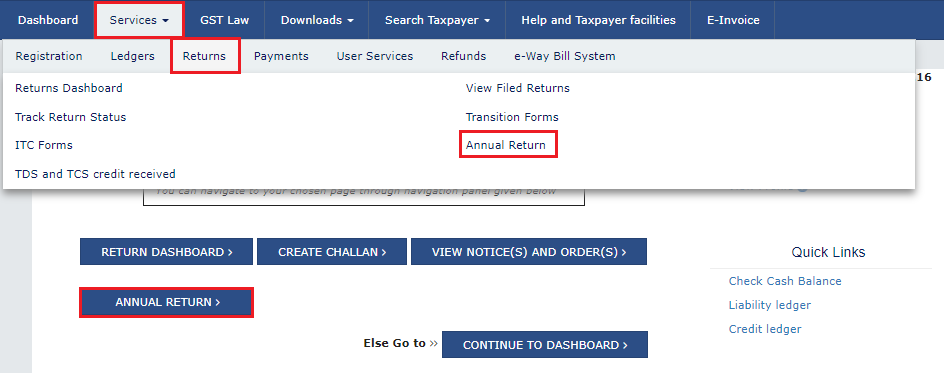

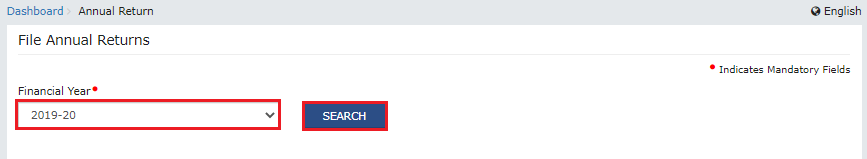

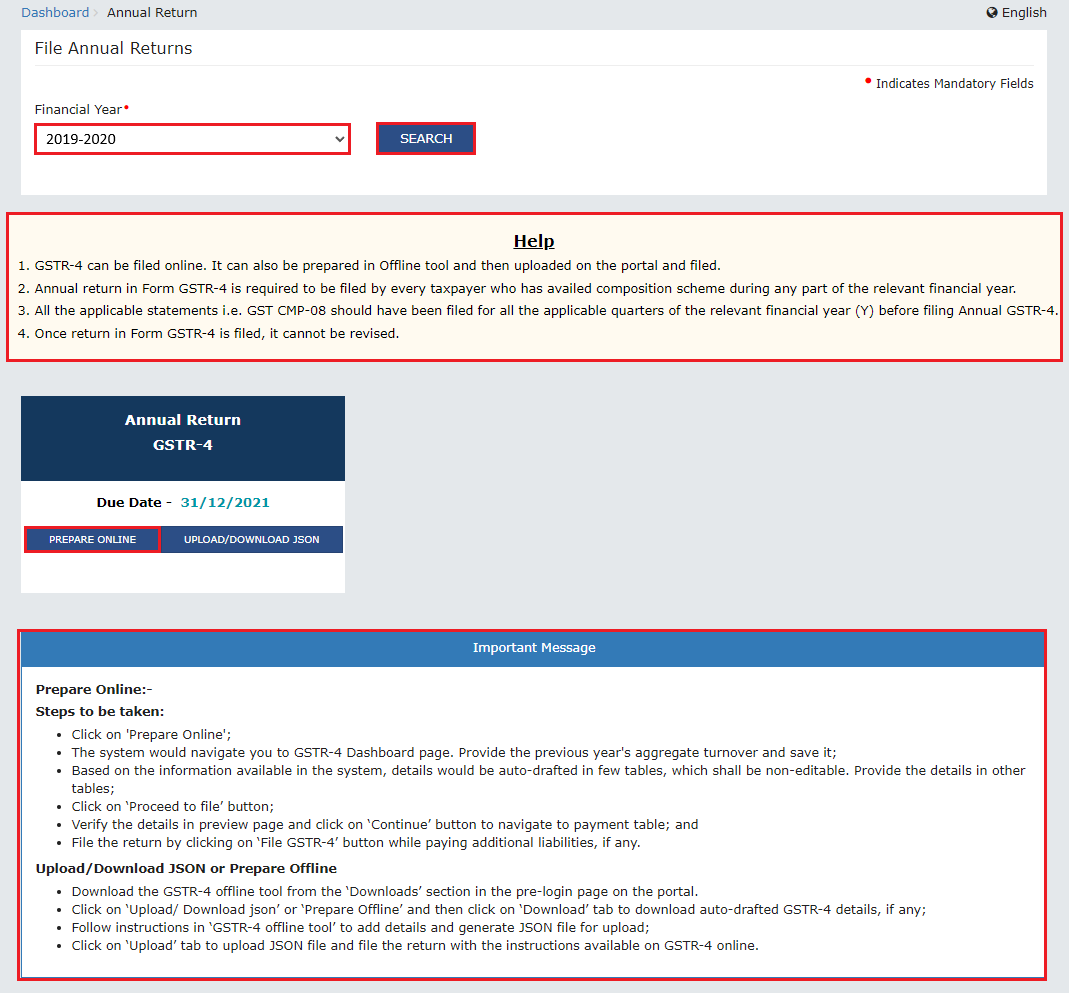

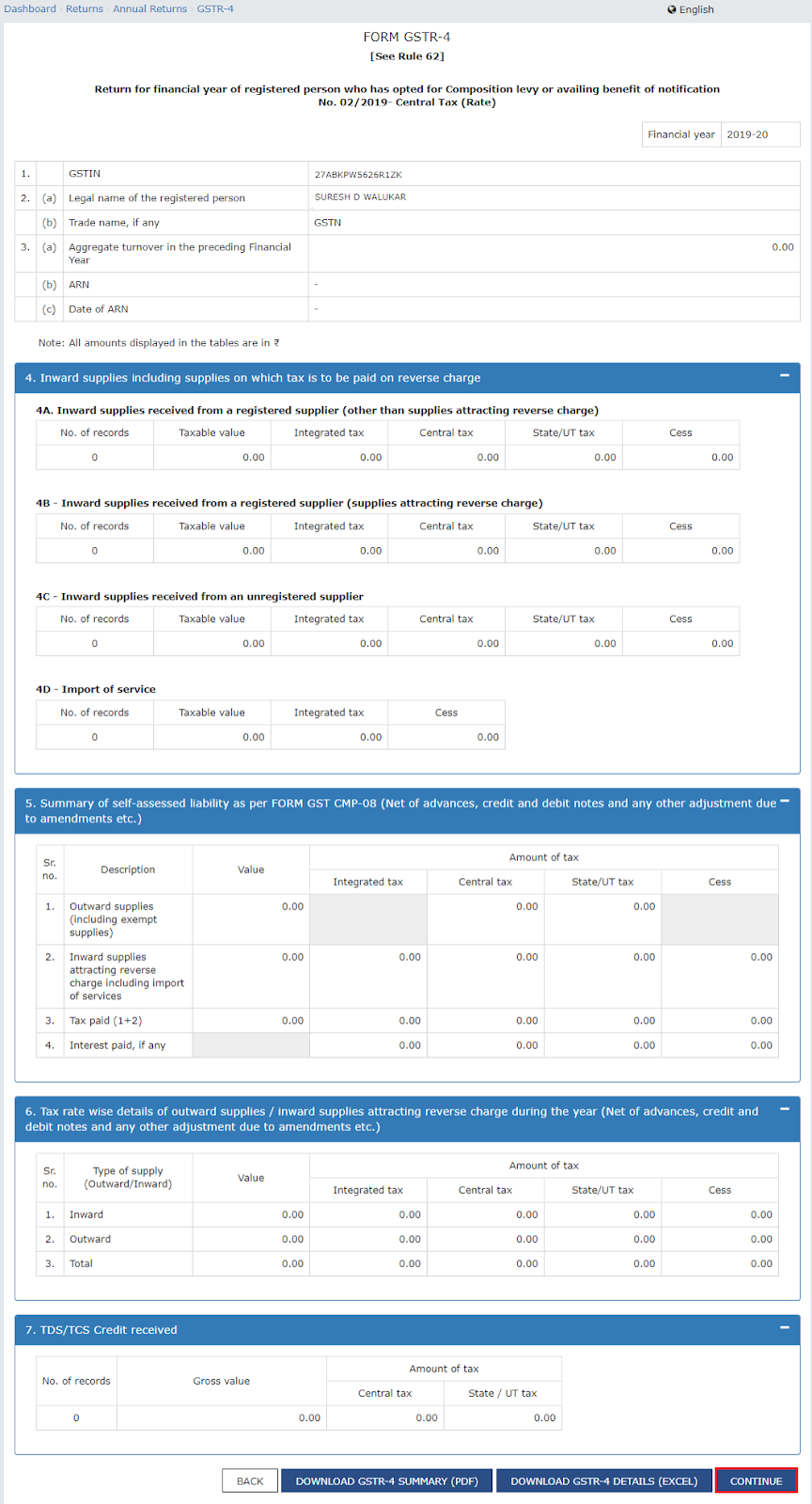

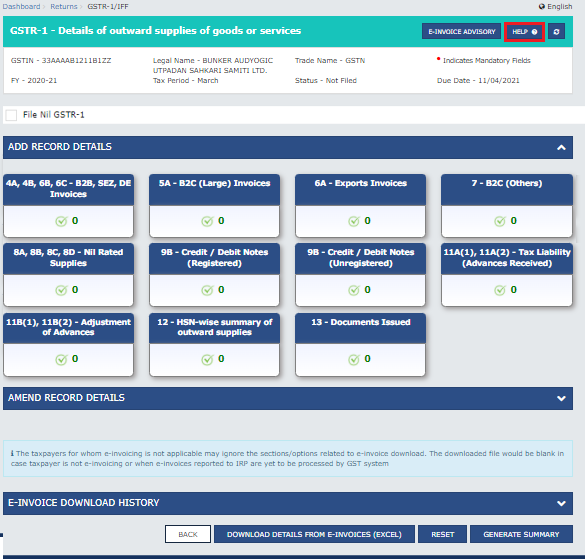

Form GSTR-4 (Annual Return) is a yearly return to be filed once, for each financial year, by taxpayers who have opted for composition scheme during the financial year, for were in Composition scheme for any period during the said financial year, from 1st April, 2019 onwards. Such taxpayers are required to furnish details regarding summary of outward supplies, Inward supplies, import of services and supplies attracting reverse charge in this form.

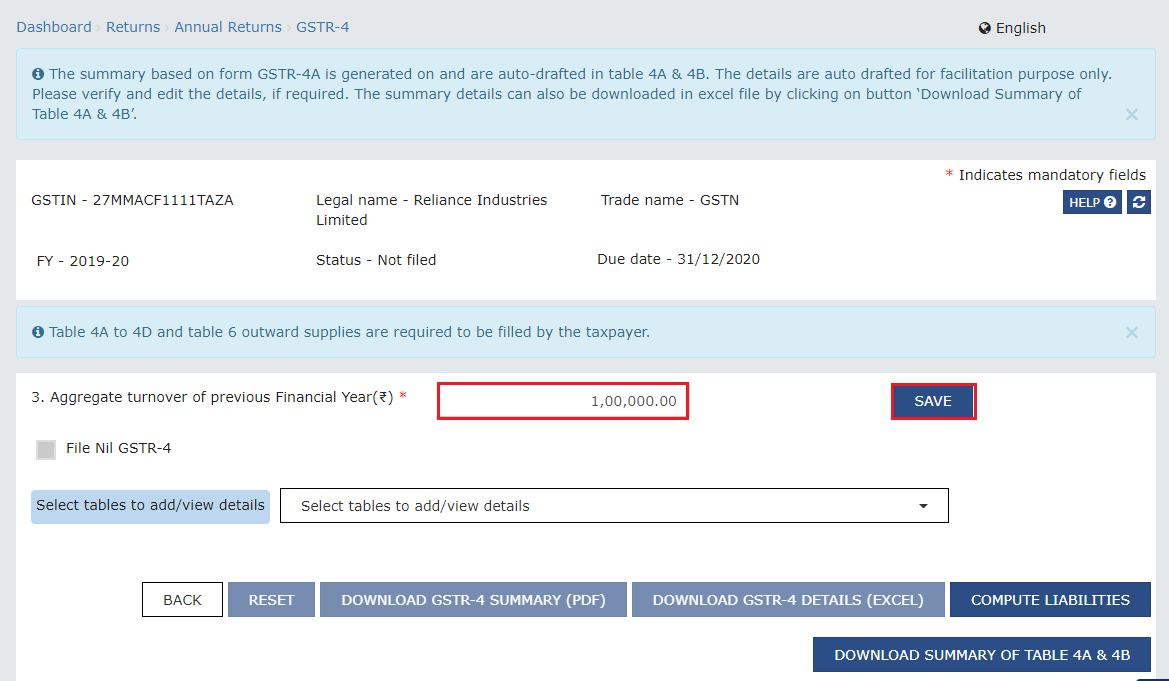

Note: You can click the Help link to view Help related to this page.

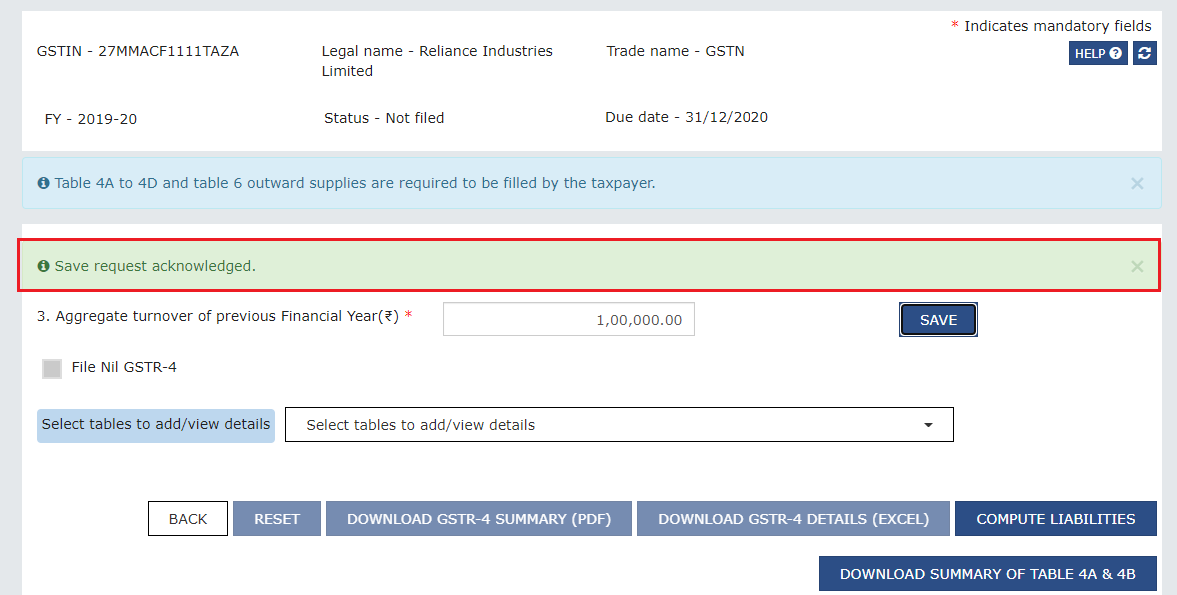

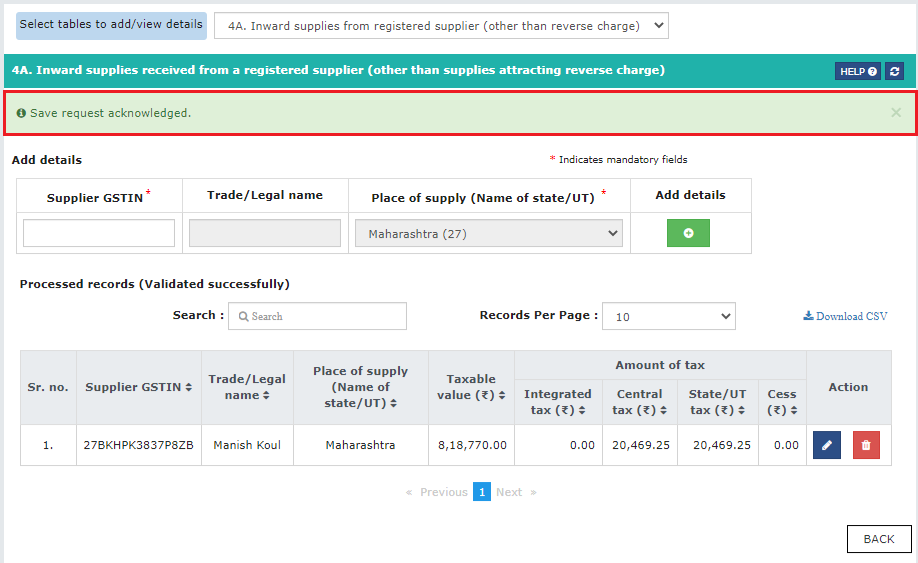

A confirmation message is displayed that Save request has been acknowledged.

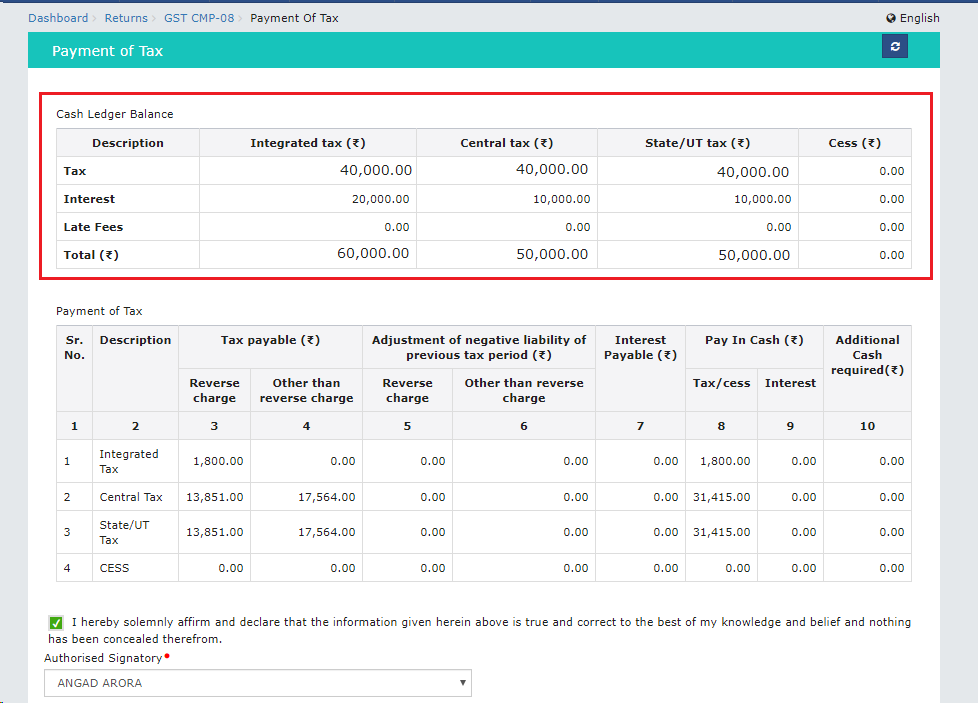

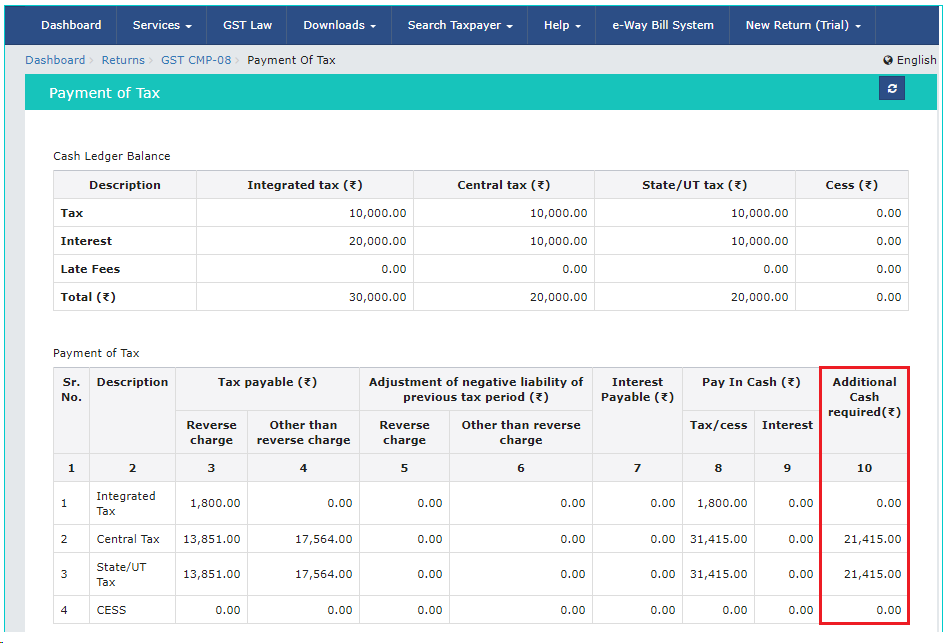

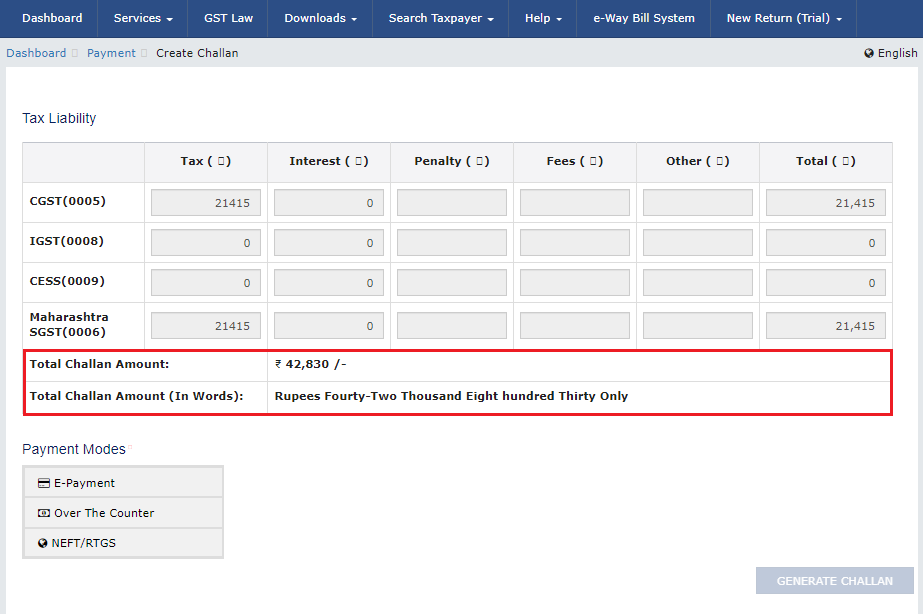

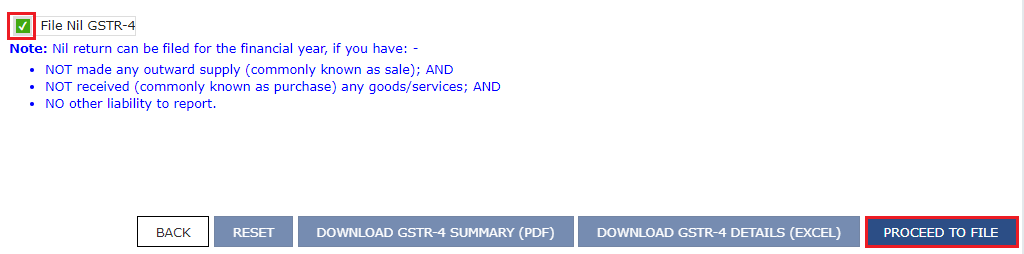

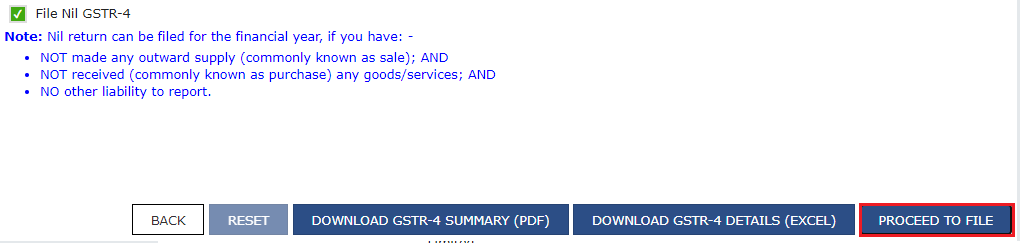

Return is ready to be filed. Click PROCEED TO FILE.

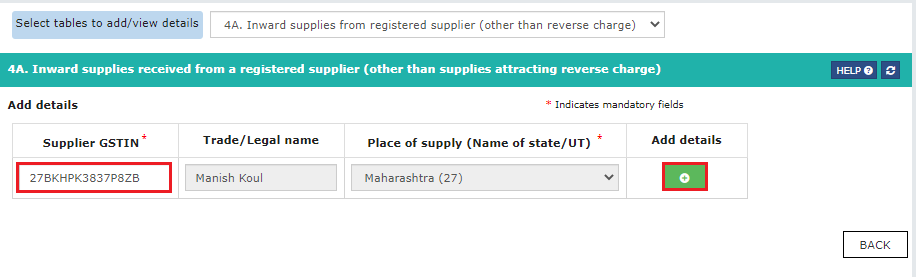

In the Supplier GSTIN field, enter the GSTIN of the supplier. Once the GSTIN of the supplier is entered, Trade/Legal Name fields are auto-populated based on the GSTIN of the supplier.

Click the Add (+) button.

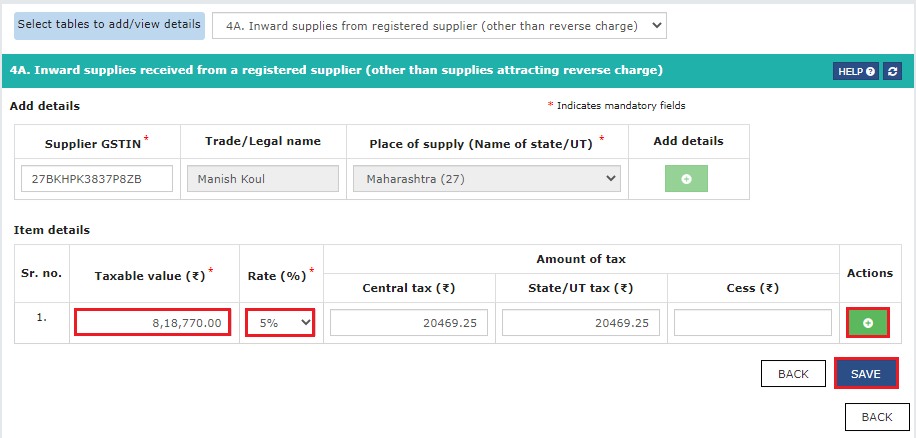

On clicking the Add (+) button, the Item Details fields get displayed. Enter the item details of the document and click the Add (+) button to add more rows. Once all the details are entered, click SAVE.

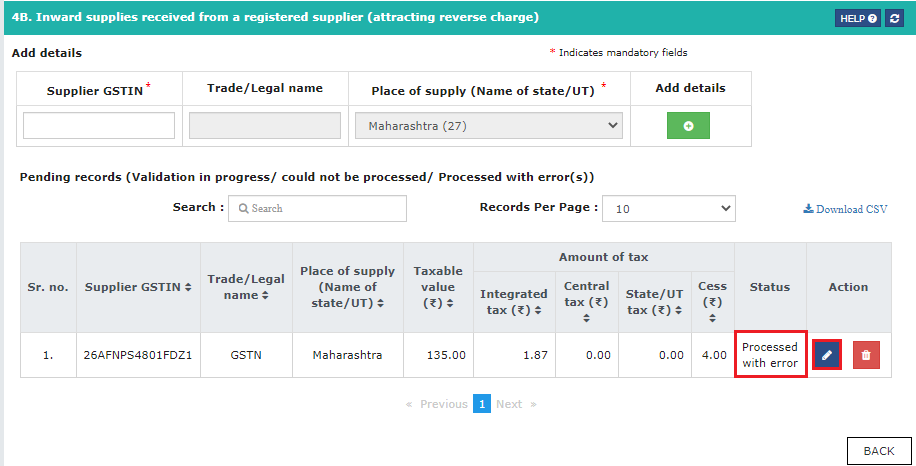

Once the details are saved, a success message gets displayed. The details of the document are validated by the GST Portal and are added to the Pending Records table till the validation is completed. Post successful validation, the document gets added to the Processed records (Validated successfully) section of this page. You may refresh the page to see the most updated status of documents. In case, the documents are processed with error, it would be available in ‘Pending Records’ table with status as ‘Processed with error’. You may click edit to see the error and correct the same.

Note: Similarly, you can enter other details for the table.

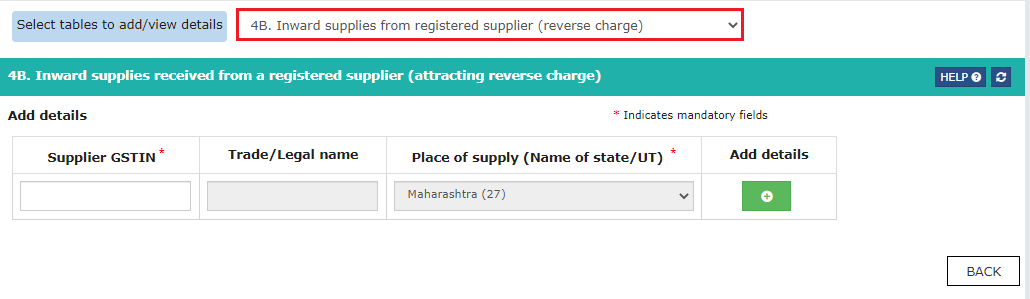

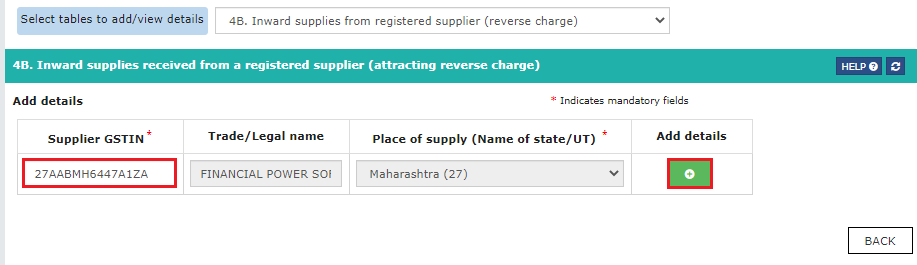

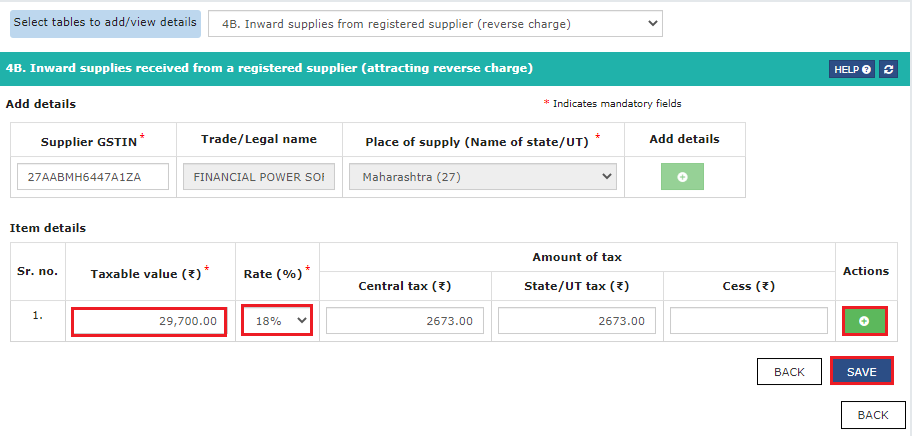

In the Supplier GSTIN field, enter the GSTIN of the supplier. Once the GSTIN of the supplier is entered, Trade/Legal Name fields are auto-populated based on the GSTIN of the supplier. Click the Add (+) button.

Note: Inward supplies other than those attracting reverse charge, are not to be provided in table 4B and the same need be provided in table 4A

On clicking the Add (+) button, the Item Details fields get displayed. Enter the item details of the document and click the Add (+) button to add more rows. Once all the details are entered, click SAVE.

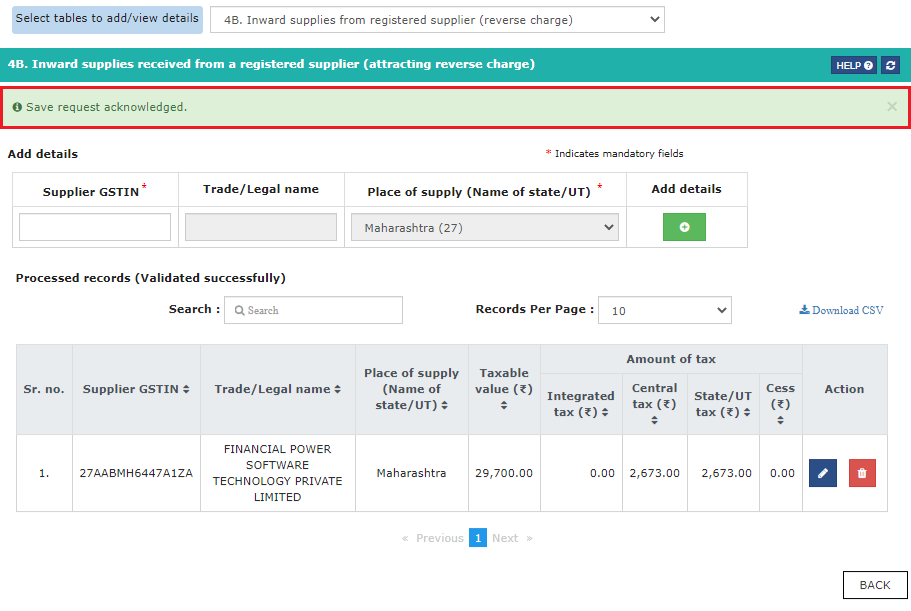

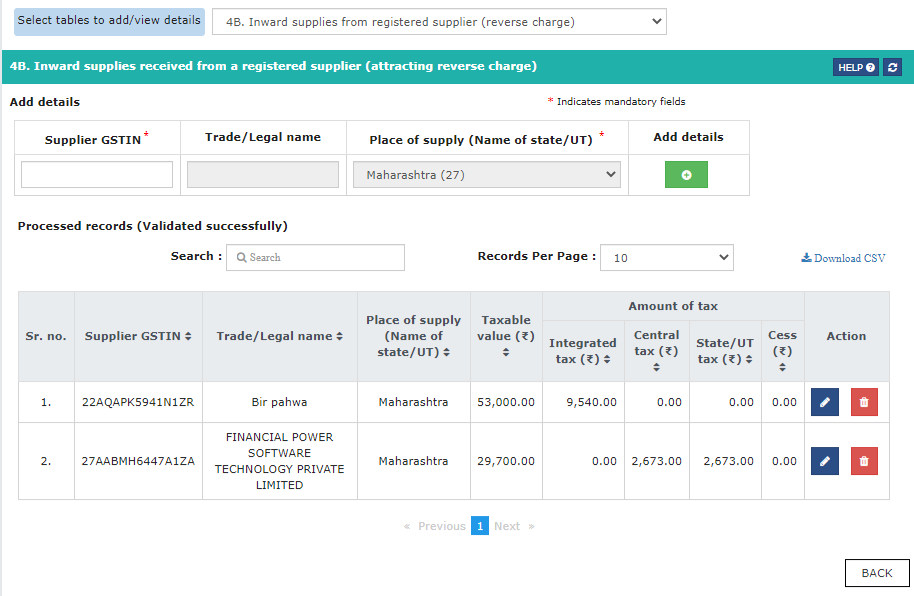

Once the details are saved, a success message gets displayed. The details of the document are validated by the GST Portal and are added to the Pending Records table till the validation is completed. Post successful validation, the document gets added to the Processed records (Validated successfully) section of this page. You may refresh the page to see the most updated status of documents. In case, the documents are processed with error, it would be available in ‘Pending Records’ table with status as ‘Processed with error’. You may click edit to see the error and correct the same.

Note: Similarly, you can enter other details for the table.

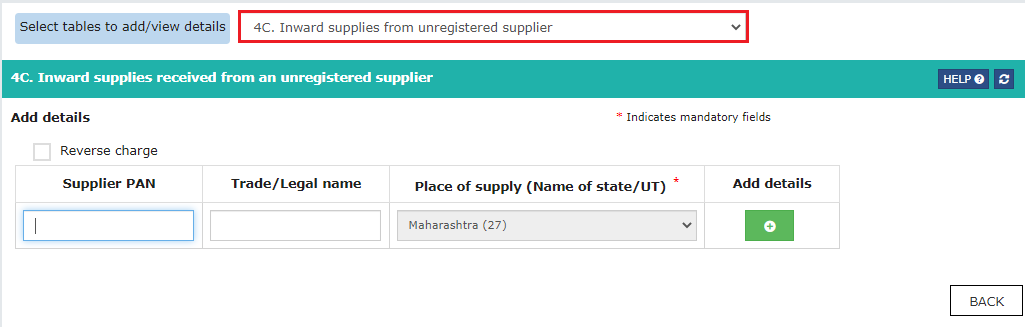

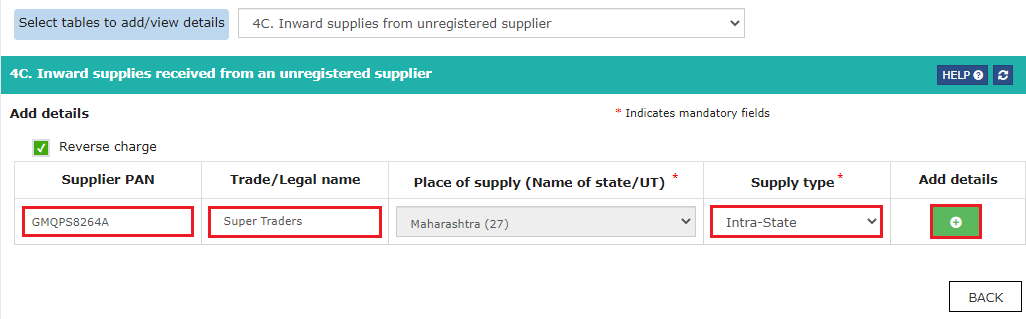

Select the checkbox for Reverse Charge, if applicable. In the Supplier PAN field enter the PAN of the supplier, if any. Enter the Trade/Legal Name of the supplier. In case of supplies liable to reverse charge, select the Supply Type from the drop-down list. Click the Add (+) button.

Note: The record can also be added without providing the PAN details, if same is not available

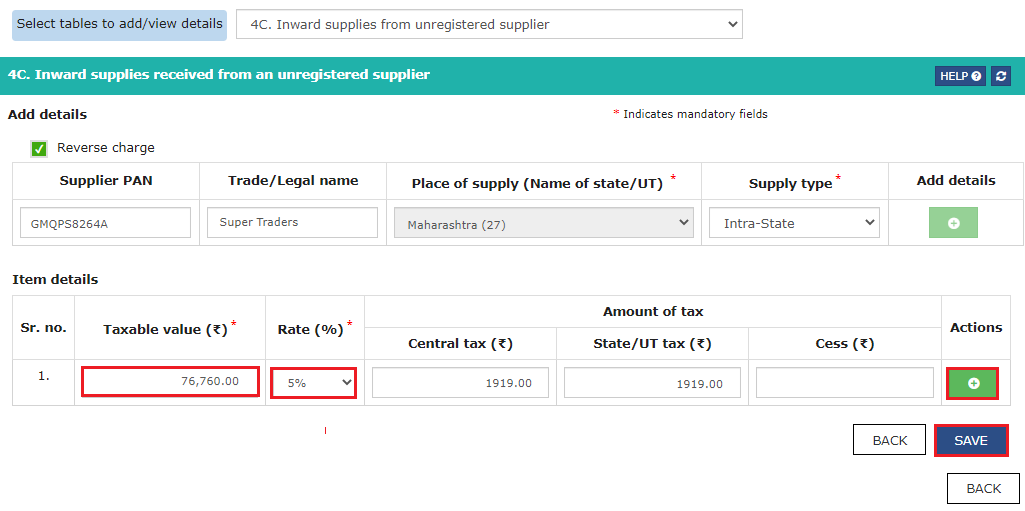

On clicking the Add (+) button, the Item Details fields get displayed. Enter the item details of the document and click the Add (+) button to add more rows. Once all the details are entered, click SAVE.

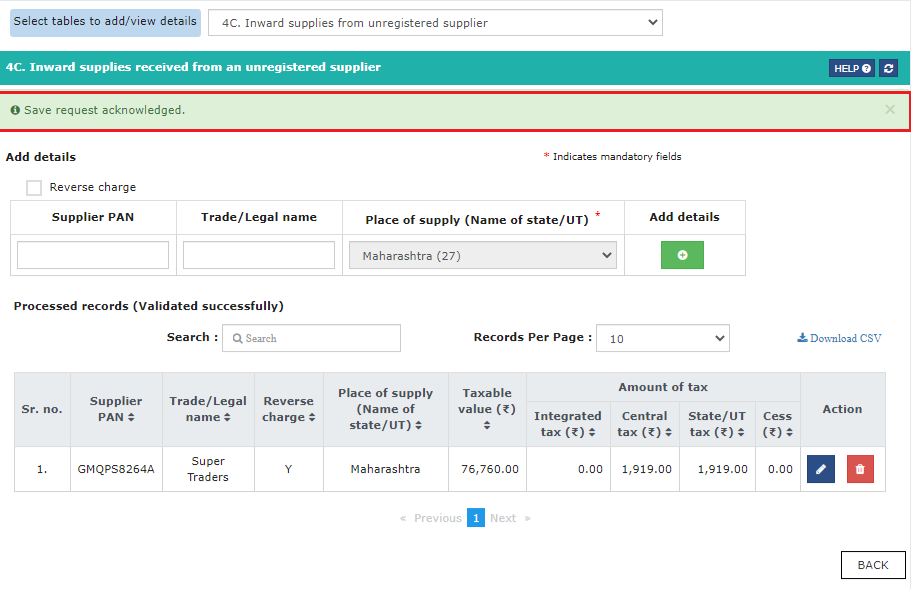

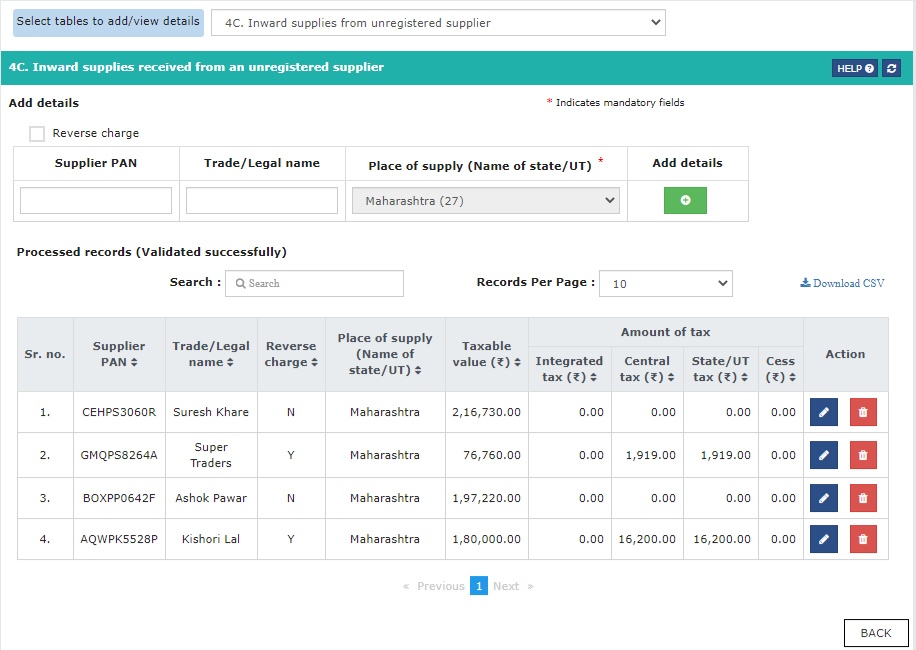

Once the details are saved, a success message gets displayed. The details of the document are validated by the GST Portal and are added to the Pending Records table till the validation is completed. Post successful validation, the document gets added to the Processed records (Validated successfully) section of this page. You may refresh the page to see the most updated status of documents. In case, the documents are processed with error, it would be available in ‘Pending Records’ table with status as ‘Processed with error’. You may click edit to see the error and correct the same.

Note: Similarly, you can enter other details for the table.

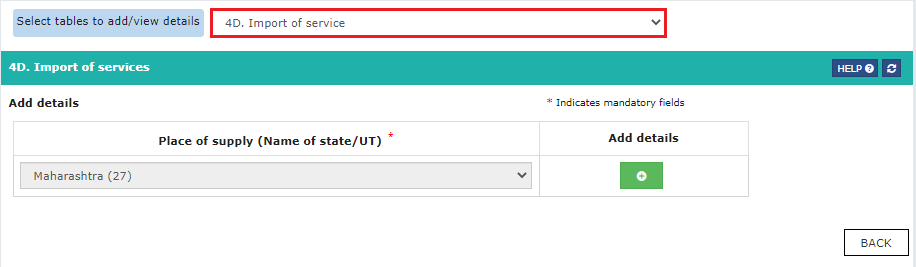

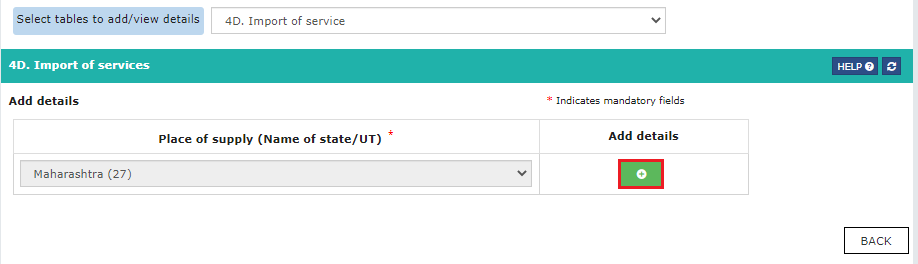

Click the Add (+) button.

Note: Place of Supply of the recipient is shown as the State/UT in which the recipient is registered, by default and cannot be edited.

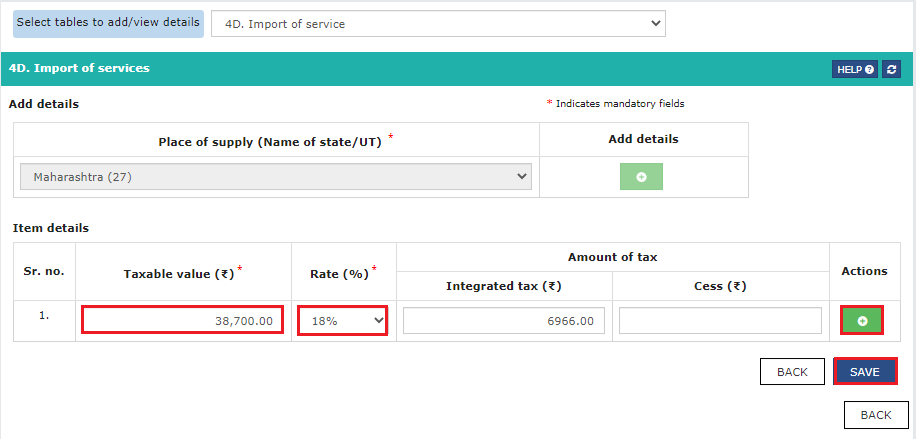

On clicking the Add (+) button, the Item Details fields get displayed. Enter the item details of the document and click the Add (+) button to add more rows. Once all the details are entered, click SAVE.

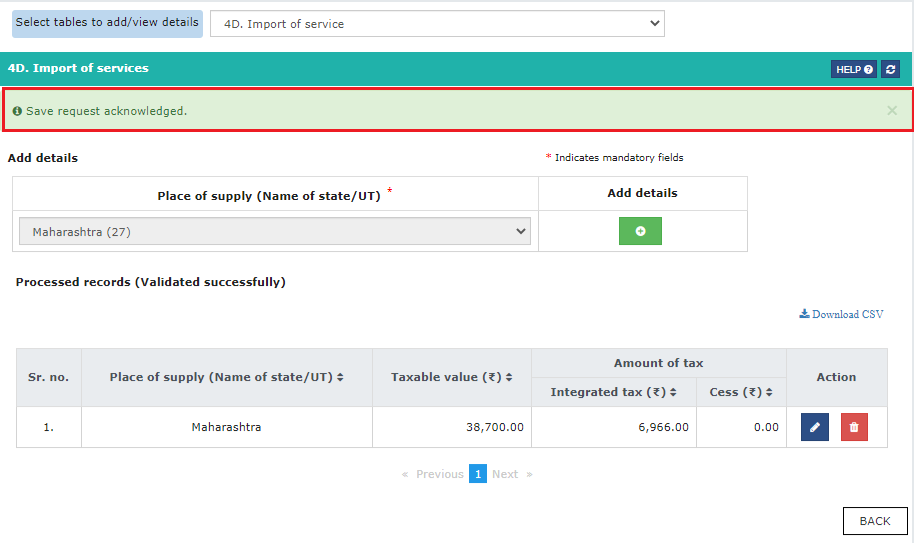

Once the details are saved, a success message gets displayed. The details of the document are validated by the GST Portal and are added to the Pending Records table till the validation is completed. Post successful validation, the document gets added to the Processed records (Validated successfully) section of this page. You may refresh the page to see the most updated status of documents. In case, the documents are processed with error, it would be available in ‘Pending Records’ table with status as ‘Processed with error’. You may click edit to see the error and correct the same.

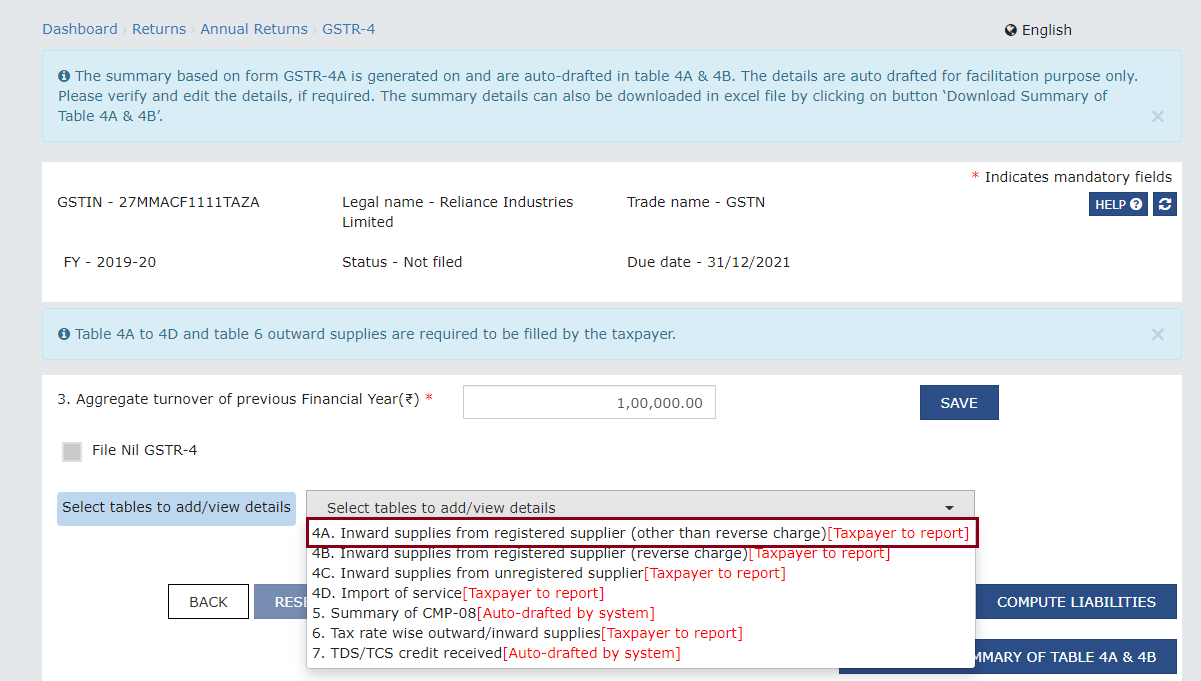

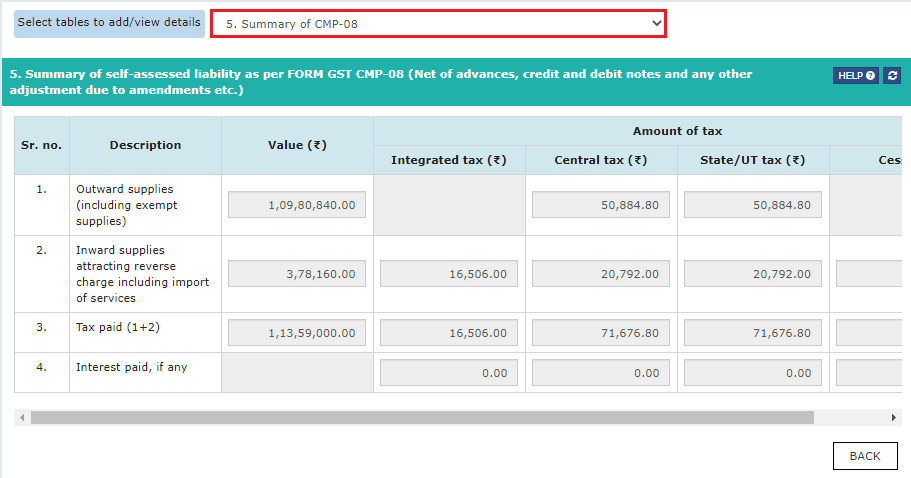

To view auto-drafted details, as provided in filed Form CMP-08 for the financial year, select 5. Summary of CMP-08 from the "Select tables to add/view details" drop-down list.

Note: Summary of self-assessed liability is auto-populated in Table-5 of GSTR-4 Annual Return on basis of filed Form CMP-08 & is non-editable.

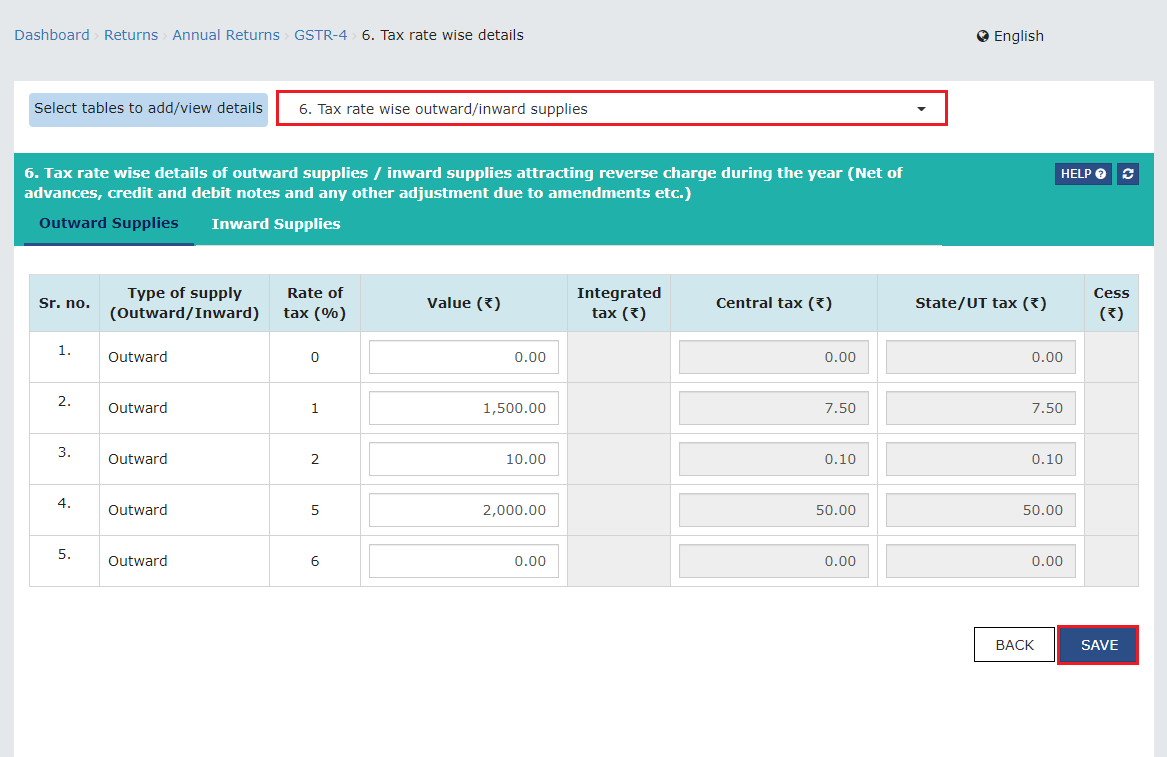

Tax rate wise inward supplies attracting reverse charge and outward supplies

There are two separate tabs for Outward Supplies and Inward Supplies.

Enter the details and click SAVE.

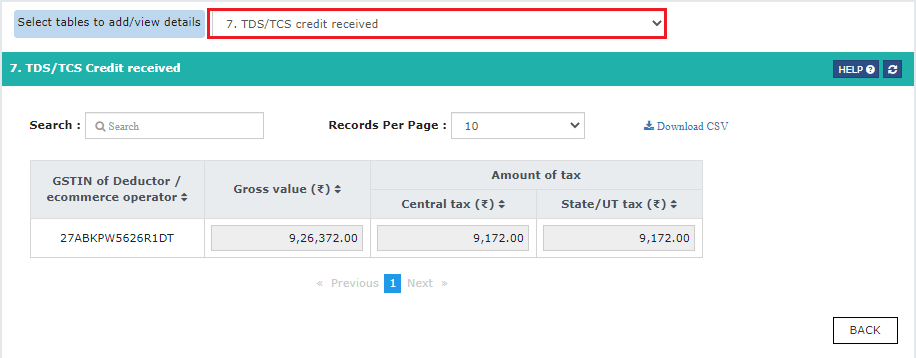

TDS/TCS credit received

Click on the BACK button to navigate to the Form GSTR-4 form. Click the Compute Liabilities button and further click the Refresh button after a few minutes.

Note: Click the Refresh button. The Compute Liabilities button disappears and the Proceed to File button appears.

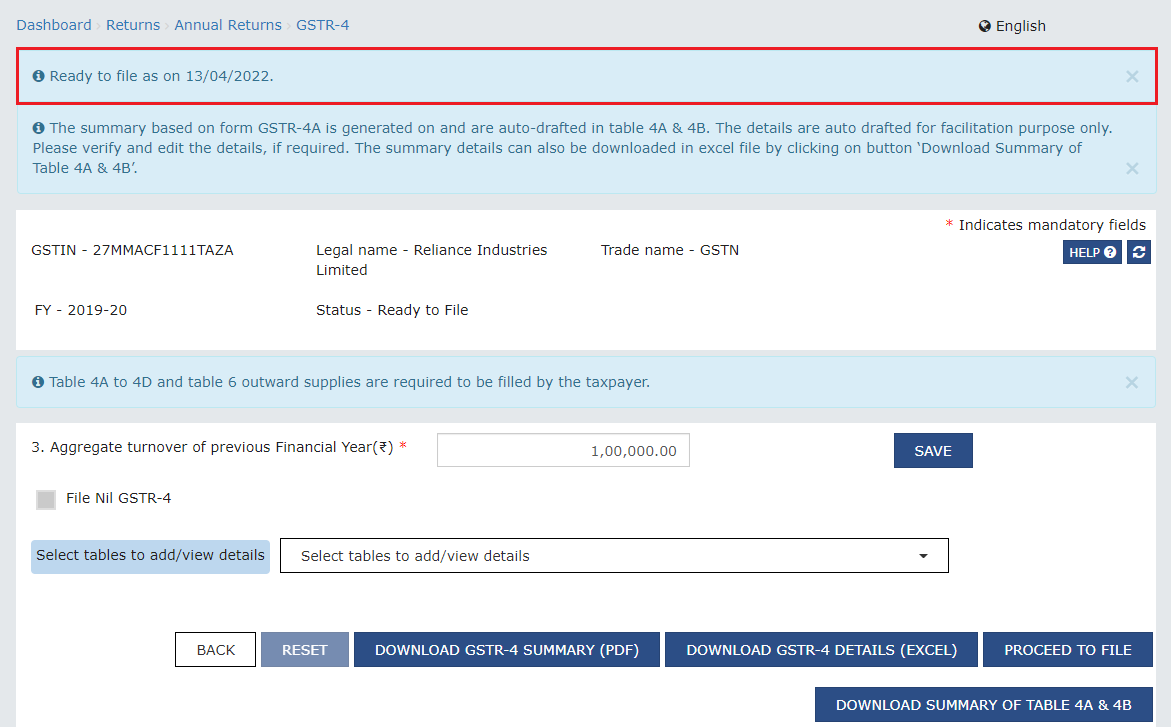

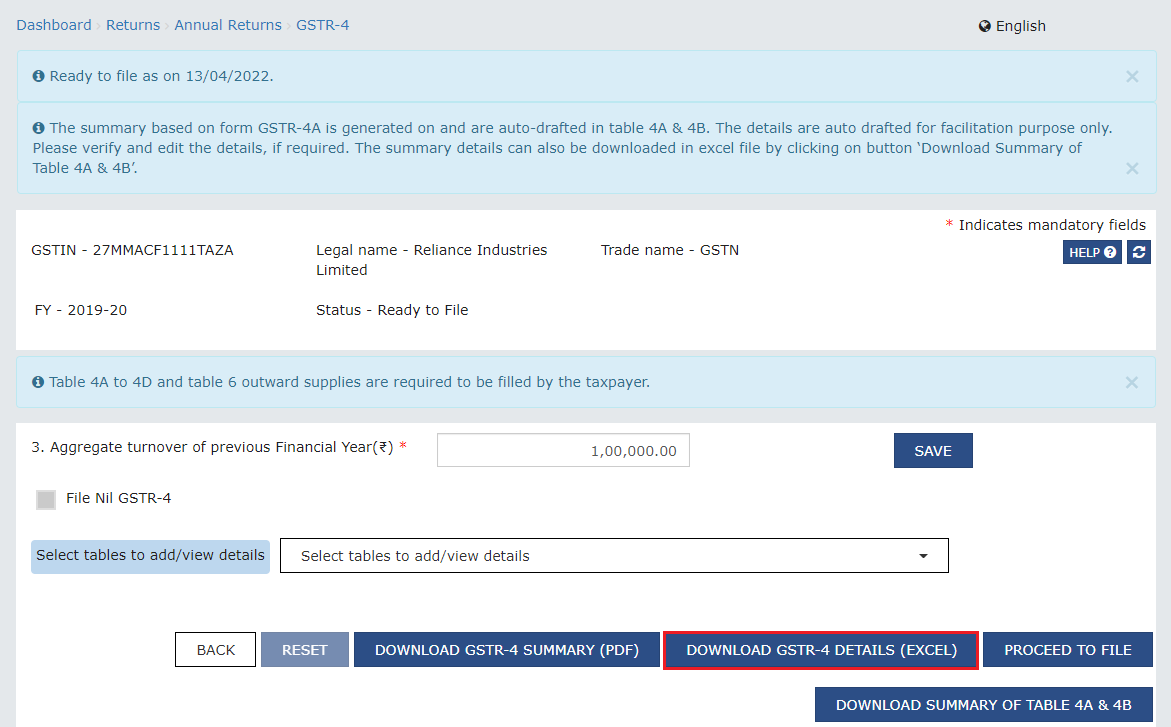

The Compute Liabilities button disappears and the Proceed to File button appears. The Ready to file message is displayed.

Click the DOWNLOAD GSTR-4 SUMMARY (PDF)/ DOWNLOAD GSTR-4 (EXCEL) button to download the Form GSTR-4 (Annual Return) summary in PDF or the Excel format. This button will download the draft Summary page of your Form GSTR-4 (Annual Return) for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections before filing Form GSTR-4 (Annual Return).

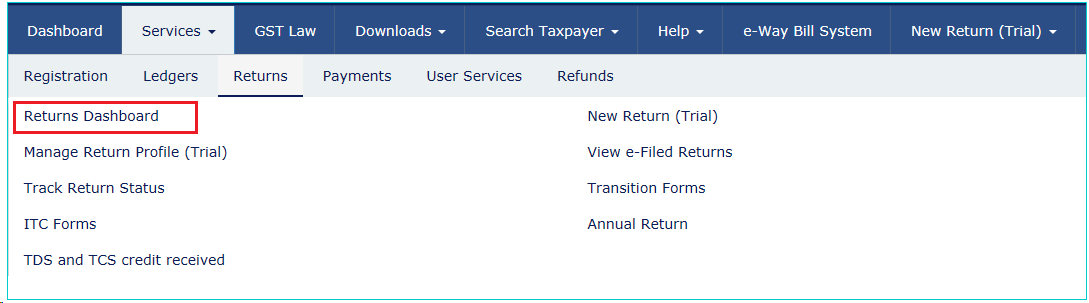

The GST Composition Scheme streamlines tax procedures for small businesses with a turnover under Rs. 1.5 crore. Composition dealers file Form CMP-08 quarterly, declaring self-assessed tax details, and an annual return in Form GSTR-4. The process involves navigating the GST portal, entering specific details for various transaction types, and ensuring compliance with deadlines. Opting for this scheme offers simplicity, but adherence to filing requirements is crucial for a smooth GST journey.

composition scheme under gst

gst composition scheme

composition scheme

gstr 4

gstr-4

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More