On 31st July, 2023, CBIC issued Notification no. 28/2023-Central Tax. It was mentioned in the said notification that the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act, 2023 shall come into force w.e.f. 01st of October, 2023.

Also, it specified that the provisions of sections 149 to 154 of the said Act shall come into force w.e.f. 01st of August, 2023.

To understand sections 137 to 139 of the Finance Act, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part I”.

To understand sections 140 to 146 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part II’’.

Let's discuss sections 147 to 156 of the Finance Act, 2023 in this part!

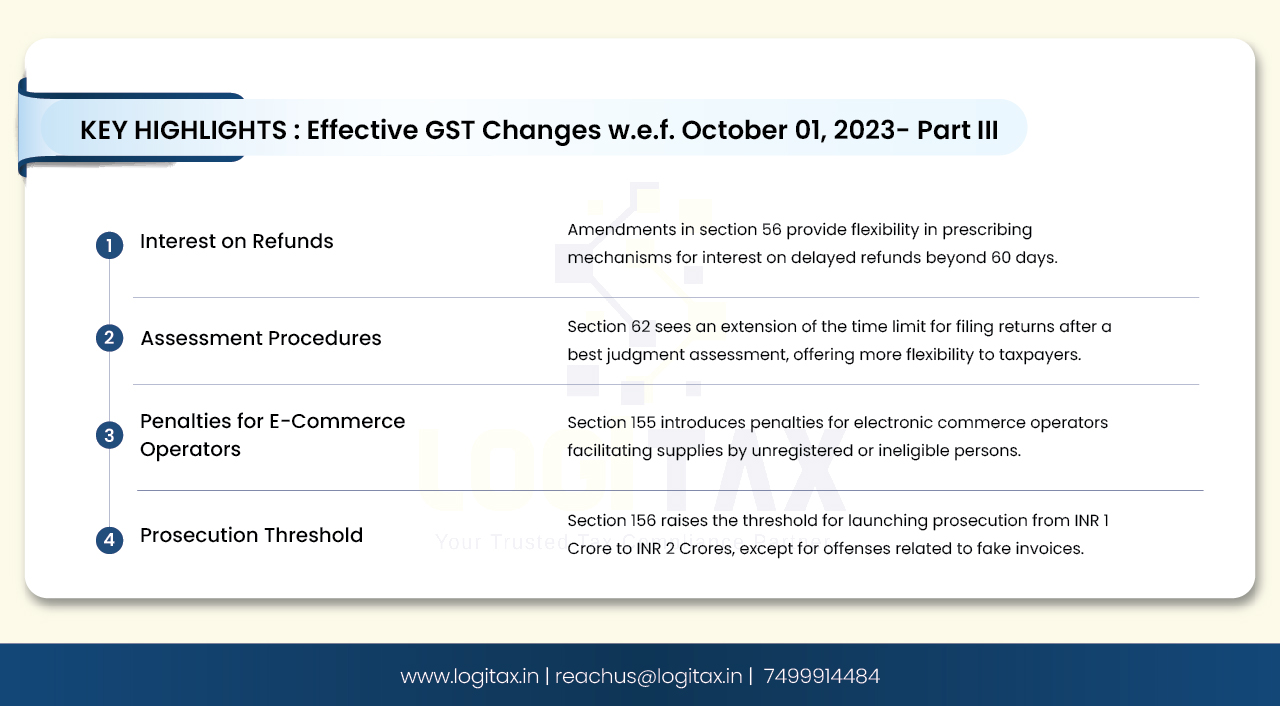

Section 147 deals with amendments in section 56 of the CGST Act, 2017.

Section 56 of the CGST Act, 2017 covers provisions related to Interest on delayed refunds.

Earlier, section 56 stated that if any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under sub-section (1) of that section, interest at such rate not exceeding six per cent. as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax.

Now, the wordings “from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax” are changed to “for the period of delay beyond sixty days from the date of receipt of such application till the date of refund of such tax, to be computed in such manner and subject to such conditions and restrictions as may be prescribed”.

It means that the government will be empowered to prescribe the mechanism, computation, manner, and restrictions for payment of interest on delayed refunds beyond 60 days from the date of receipt of refund application until the date of refund.

Section 148 deals with amendments in section 62 of the CGST Act, 2017.

Section 62 of the CGST Act, 2017 covers provisions related to the Assessment of non-filers of returns.

Section 62 of the CGST Act, 2017 states that when a registered person fails to file the returns even after show cause notice, the proper officer may pass an order under best judgment assessment. However, where a registered person files the returns within 30 days of the service of the best judgment assessment order, the said assessment order shall be deemed to have been withdrawn. This time limit of 30 days is extended to 60 days by way of this amendment. The period of 60 days may further be extended to 120 days on the payment of additional late fees above the standard late fee.

These sections deal with amendments to sections 109, 110, 114, 117, 118, and 119 of the CGST Act. All these sections cover provisions relating to the constitution of Appellate Authority and assessments.

Section 155 deals with amendments to section 122 of the CGST Act, 2017.

Section 122 covers provisions relating to penalties for certain offenses. A new sub-section 1B is inserted in it as follows:

“(1B) Any electronic commerce operator who

Shall be liable to pay a penalty of ten thousand rupees, or an amount equivalent to the amount of tax involved had such supply been made by a registered person other than a person paying tax under section 10, whichever is higher.”

By way of this amendment, penal provisions are introduced for electronic commerce operators in cases where there is a violation of specified provisions relating to supplies of goods made through ECO by unregistered persons or composition taxpayers. The maximum penalty amount is Rs.20,000/- or the tax amount involved in such supply, whichever is higher.

Section 156 deals with amendments to section 132 of the CGST Act, 2017.

Section 132 covers provisions relating to Punishment for certain offenses.

Its sub-section 1 states that Whoever commits, or causes to commit and retain the benefits arising out of, any of the mentioned offenses, shall be punishable with imprisonment or fine, or both.

From the list of offenses, the following sub-clauses are removed:

(g) Obstructs or prevents any officer in the discharge of his duties under this Act

(j) Tampers with or destroys any material evidence or documents

(k) Fails to supply any information which he is required to supply under this Act or the rules made thereunder or (unless with a reasonable belief, the burden of proving which shall be upon him, that the information supplied by him is true) supplies false information

Further, this amendment will increase the limit for launching prosecution from INR 1 Crore to INR 2 Crores except for the offense of issuance of invoice without supply of goods or services.

Thus, in case of offenses, other than fake invoices, prosecution provisions will be initiated if the value of taxes is more than Rs. 2 Crores. For fake invoices, the prosecution will continue as for the threshold tax amount of Rs. 1 Crore.

In conclusion, the recent amendments to the GST laws effective from October 1, 2023, bring significant changes in interest on delayed refunds, best judgment assessments, penalties for electronic commerce operators, and prosecution thresholds. These modifications aim to enhance procedural efficiency, compliance, and enforcement. Stay updated and adapt to these changes for a smoother GST compliance journey.

gst latest news

gst notifications

gst

gst amendment

gst portal

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More