The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Filing GST returns is a crucial aspect of regulatory adherence for businesses enrolled in the system.

Taxpayers may encounter various GST error codes during the various submissions, each signaling a distinct issue necessitating resolution. Proficiency in decoding these error codes is indispensable for ensuring precise and punctual compliance.

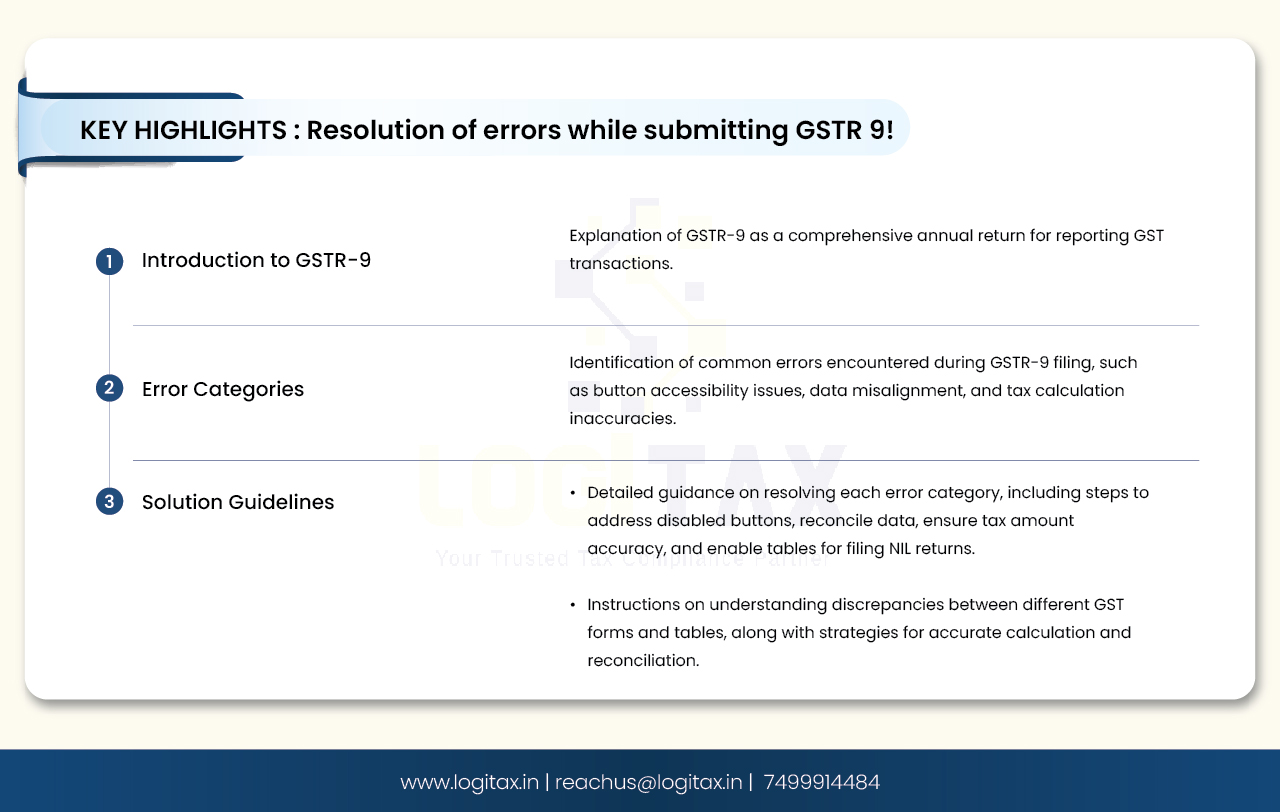

In this blog, known errors while filing GSTR 9 are decoded!

| Sr.No. | Error description | When does this issue/error occur? | Suggested solution |

|---|---|---|---|

| 1 | Proceed to file had some error | When clicking on the FILE GSTR-9 button, warning message comes to ask for Yes or No confirmation. When a user clicks on the Yes button, the page is not going ahead. The user gets stuck on the same screen and the “Proceed to File” button is disabled. When a user goes to file a NIL return and clicks on NIL return as YES, however, as per the system, he is not eligible to file a NIL return. | You are advised to please click on the "Nil" button option as 'NO' and click on the "Next" button. Then follow the below steps: 1. Click on 'Compute Liabilities'; for computation of Late fees, if any. 2. The 'Proceed to File' button will be enabled once the late fee is calculated by the system. 3. Click on “Proceed to File” to pay liabilities and file a return. Additional details can be added even after clicking on the ‘Compute Liabilities’ or ‘Proceed to file’ button. However, in that case, you would be required to follow steps 1 to 3 again to file the return. To enable the 'FILE-GSTR-9' button, please follow the below steps: 1. Click on the ‘Download Filed GSTR-9 (pdf)’ button to view the summary of filed details in PDF format. 2. Download all filed details as an excel file by clicking on ‘Download GSTR-9 details (Excel)’. |

| 2 | The "FILE GSTR-9" button is disabled | When a user attempts to file Form GSTR-09 | You are advised to please follow the below steps: 1. Click on the ‘Download Filed GSTR-9 (pdf)’ button to view the summary of filed details in PDF format. 2. Download all filed details as an Excel file by clicking on ‘Download GSTR-9 details (Excel)’. |

| 3 | GSTR-1 Summary and Table 4 mismatch in GSTR-9 form | While filing GSTR-9 | GSTR 1 and GSTR 9- Table 4 data should be matched as per Note 1. |

| 4 | Mismatch in ITC | Mismatch of ITC as per auto-populated details in table 8 A of annual return (Form GSTR-9) with ITC as shown in Form GSTR 2A | GSTR 2A and GSTR 9- Table 8A should be matched as per Note 2. |

| 5 | The tax amount should be equal to the tax rate (concessional rate) multiplied by the taxable value in Tables 17 & 18 | When a user entered an incorrect amount in the concessional rate in tax columns | You are advised to please mention the correct/exact value with exact decimal digits in the tax field, you will get the exact value in the IGST, CGST & SGST columns. |

| 6 | All tables are disabled | When a user is trying to file a NIL return and clicks on NIL return as ‘YES’ | If you are going to file form GSTR-9, you are advised to please click on the "Nil" button option as 'NO' and click on the "Next" button. Consequently, all tiles/tables will be enabled. |

You are advised to please follow the below steps for the calculation of GSTR1 data in GSTR-9 Table 4 as below:

4(a) -> B2C: all data belonging to B2CS/B2CL/CDNUR-B2CS/CDNUR-B2CL and their amendments (The aggregate value of supplies made to consumers and unregistered persons on which tax has been paid shall be declared here. This includes details of supplies made through E-Commerce operators and is to be declared net of credit notes or debit notes)

4(b) -> B2B: all data belonging to B2B except reverse-charge/Deemed/SezWithout-Payment (The aggregate value of supplies made to registered persons (including supplies made to UINs) on which tax has been paid shall be declared here. This includes supplies made through E-Commerce operators, but shall not include supplies on which tax is to be paid by the recipient on a reverse charge basis. Details of debit and credit notes are to be mentioned separately)

4(c) -> EXPWP: all data belonging to Export-With Payment section, except SEZ The aggregate value of exports on which tax has been paid shall be declared here. This excludes supplies to SEZs.

4(d) -> SEZWP: all data belonging to the B2B section which is Sez-With-Payment (The aggregate value of supplies to SEZs on which tax has been paid shall be declared here)

4(e) -> Deemed: all data belonging to the B2B section which is Deemed (The aggregate value of supplies in the nature of deemed exports on which tax has been paid shall be declared here)

4(f) -> AT/TXPD: all data belonging to AT/TXPD and their amendments (Details of all unadjusted advances i.e. an advance that has been received, and tax has been paid but the invoice has not been issued in the current year shall be declared here)

4(i) -> Credit Notes: all data belonging to Credit-Notes of 4(b),4(c),4(d),4(e) (The aggregate value of credit notes issued in respect of B2B supplies, exports, supplies made to an SEZ and deemed exports shall be declared here)

4(j) -> Debit Notes: all data belonging to Debit-Notes of 4(b),4(c),4(d),4(e) (The aggregate value of debit notes issued in respect of B2B supplies, exports, supplies made to an SEZ and deemed exports shall be declared here)

4(k) -> Upward Amendments: all data belonging to Upward Amendments of 4(b),4(c),4(d),4(e),4(h),4(i) 4(l) -> Downward Amendments: all data belonging to Downward Amendments of 4(b),4(c),4(d),4(e),4(h),4(i) (Details of amendments made to B2B supplies, exports, supplies made to an SEZ and deemed exports, credit notes, debit notes and refund vouchers shall be declared here)

5(a) -> EXPWOP: all data belonging to EXPWOP section (The aggregate value of exports (except supplies to SEZs) on which tax has not been paid shall be declared here)

5(b) -> SEZWOP: all data belonging to the B2B section that is Sez-Without-Pay (The aggregate value of supplies to SEZs on which tax has not been paid shall be declared here)

5(c) -> B2B_REVERSE_CHARGE: all data belonging to the B2B section that is a reverse charge (The aggregate value of supplies made to registered persons on which tax is payable by the recipient on the reverse charge basis. Details of debit and credit notes are to be mentioned separately)

5(d) -> Exempted: Exempted in NIL section (The aggregate value of exempted supplies shall be declared here)

5(e) -> Nil Rated: Nil Rated in NIL section (The aggregate value Nil rated supplies shall be declared here)

5(f) -> Non-GST supply: Non-GST Supply in NIL section (The aggregate value of Non-GST supplies shall be declared here. This includes ‘no supply’)

5(h) -> CreditNotes: all data belonging to CreditNotes of 5(a),5(b),5(c) (The aggregate value of credit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E, and 5F shall be declared here)

5(i) -> DebitNotes: all data belonging to DebitNotes of 5(a),5(b),5(c) (The aggregate value of debit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E, and 5F shall be declared here)

5(j) -> Upward Amendments: all data belonging to Upward Amendments of 5(a),5(b),5(c),5(h),5(i) 5(k) -> Downward Amendments: all data belonging to Downward Amendments of 5(a),5(b),5(c),5(h),5(i) (Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here)

Please note that GSTR2A data will not always match with GSTR-9 --> Table 8A data because of the following reasons:

Navigating errors while submitting GSTR 9 can be challenging, but understanding the common issues and their resolutions can streamline the process. By following the outlined steps and solutions, taxpayers can effectively address errors, ensuring timely and accurate filing. Regularly updating and verifying data, along with adhering to the specified procedures, helps maintain compliance and avoid potential penalties. Staying informed about these common errors and their fixes will enhance your GST filing experience and contribute to smoother business operations.

gstr 9

gstr 9 due date

gstr 9c

gstr 9 applicability

gstr 9 turnover limit

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More