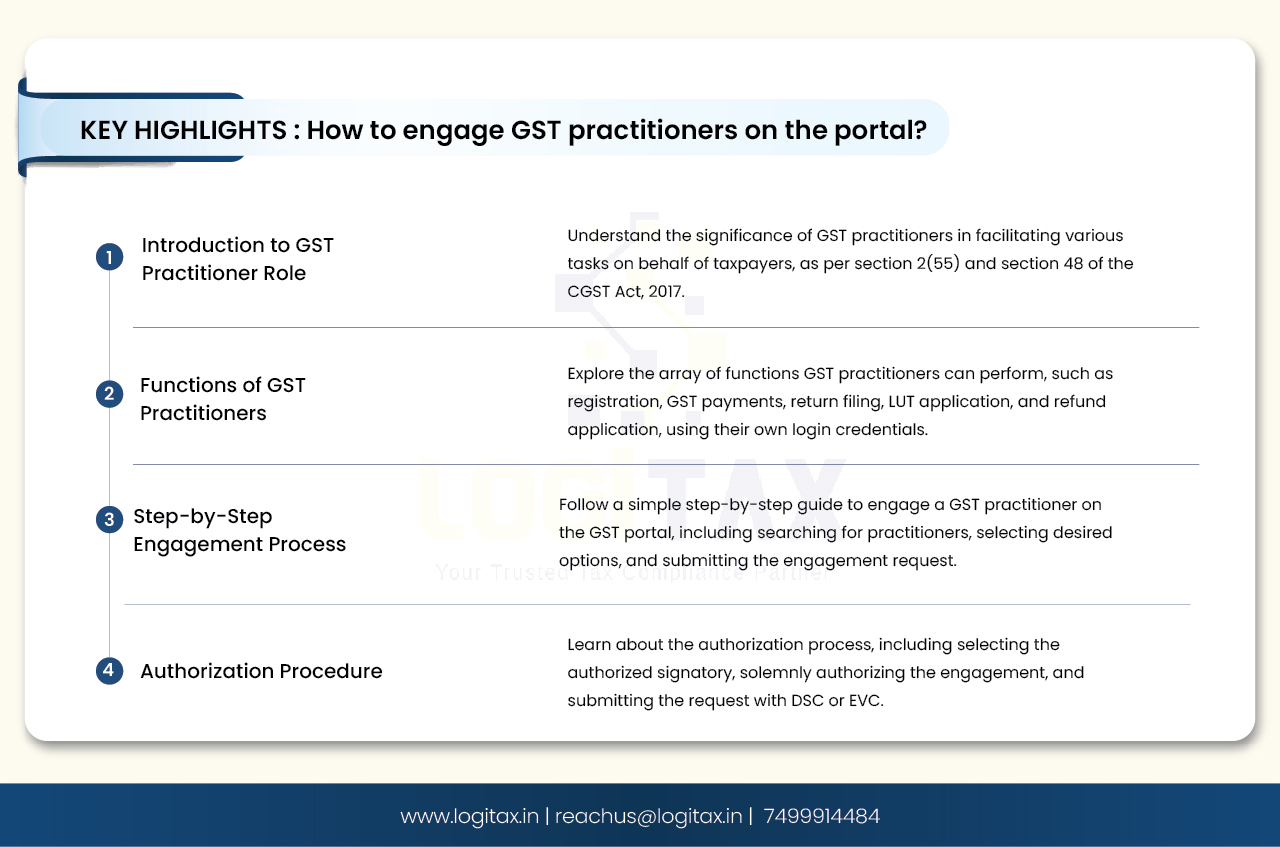

As per section 2(55) of the CGST Act, 2017, "goods and services tax practitioner" means any person who has been approved under section 48 to act as such practitioner. As per section 48, the GST practitioner should get approval from the GSTN and also, and he needs to fulfill his duties and obligations as may be prescribed.

Many functions can be performed by the GST practitioner on behalf of the taxpayer using his login such as application for registration, GST payments, creating returns, creating LUT application, creating refund application, etc.

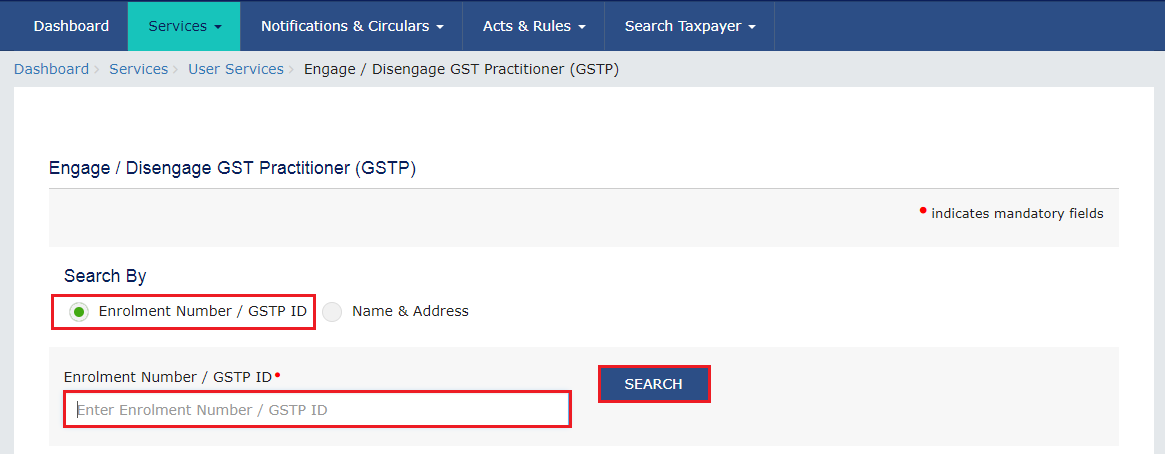

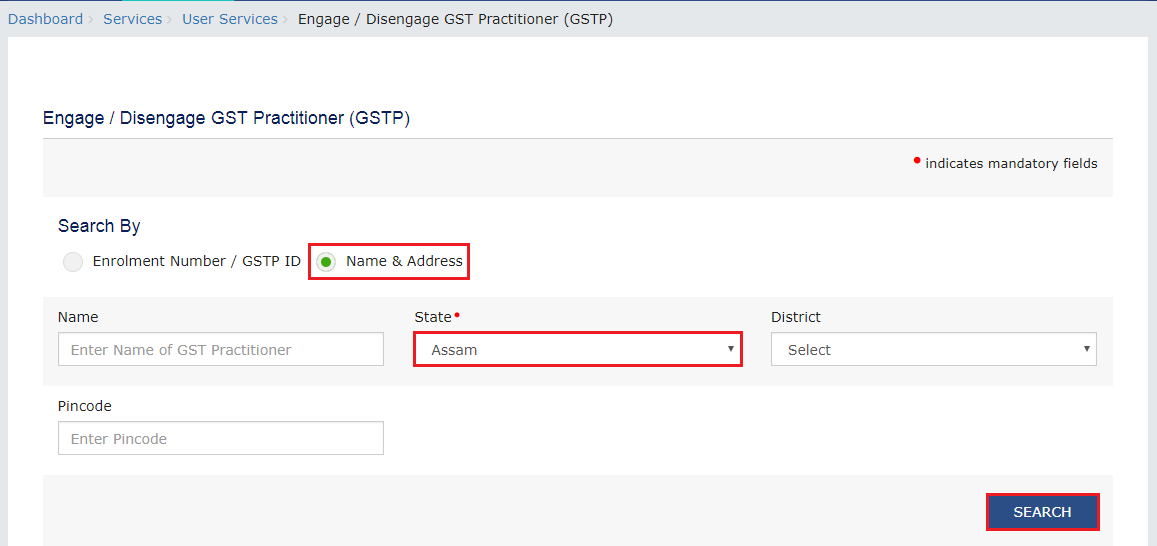

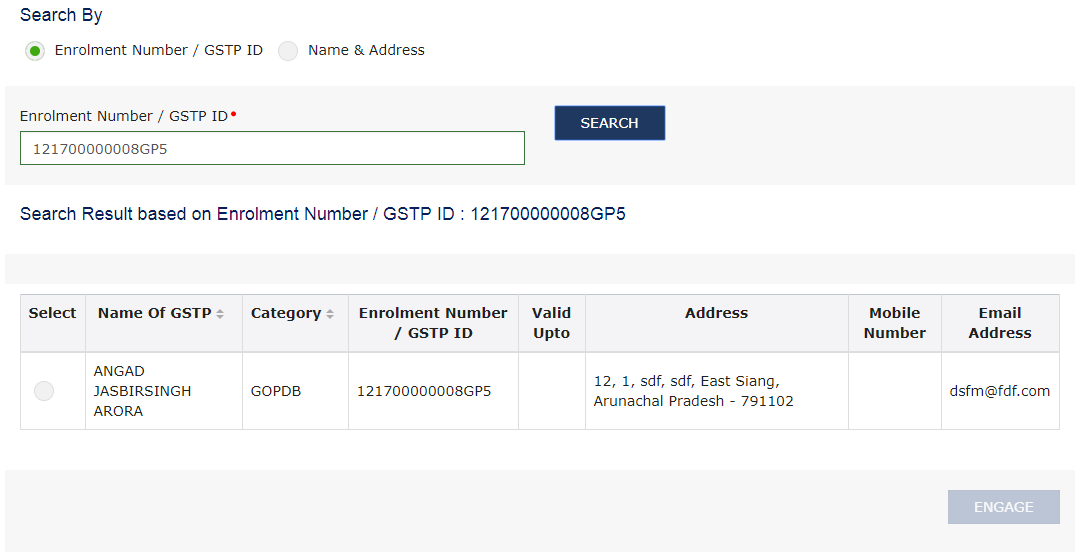

Note: You can Sort / Filter the listed GST Practitioners on the basis of Category and the Name of the GST Practitioner.

Note: Only one GST Practitioner can be engaged at a time.

Notes:

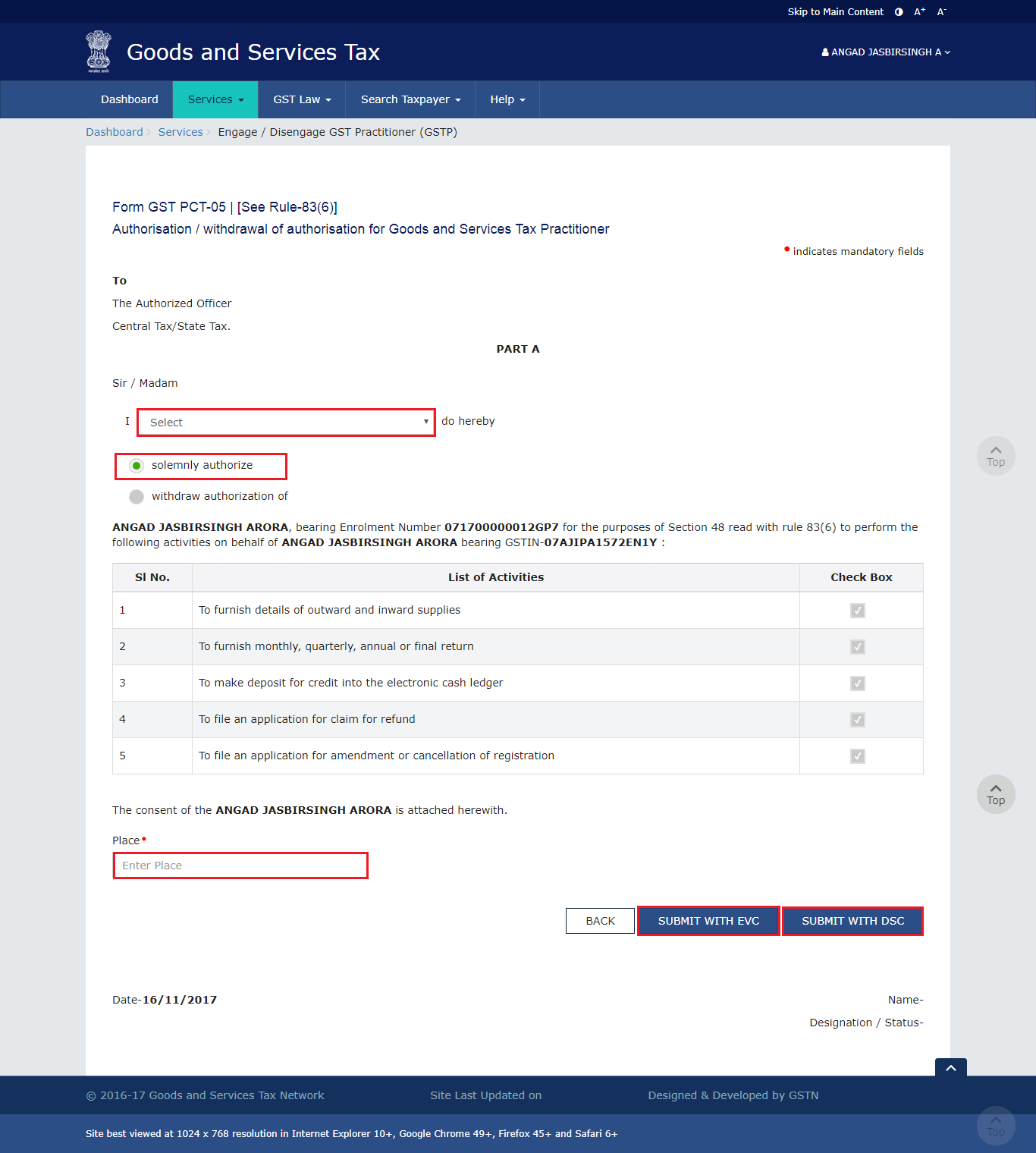

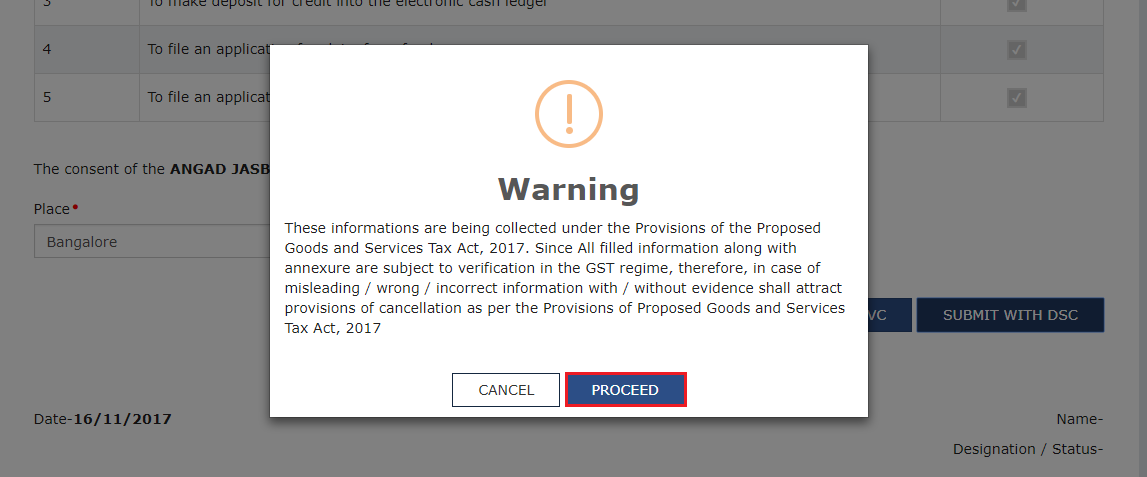

12. Once you click SUBMIT WITH DSC, the system will show a warning message; Click PROCEED.

13. Select the certificate and click the Sign button.

12. Enter the OTP and click the VALIDATE OTP button.

Notes:

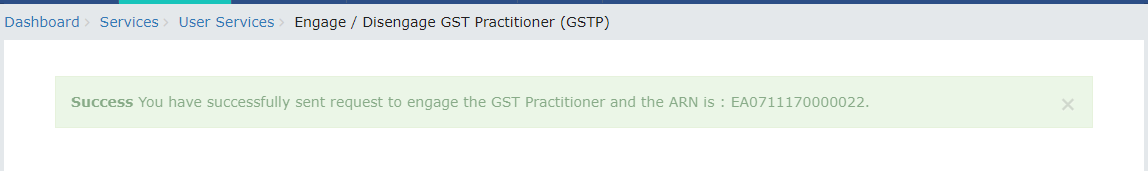

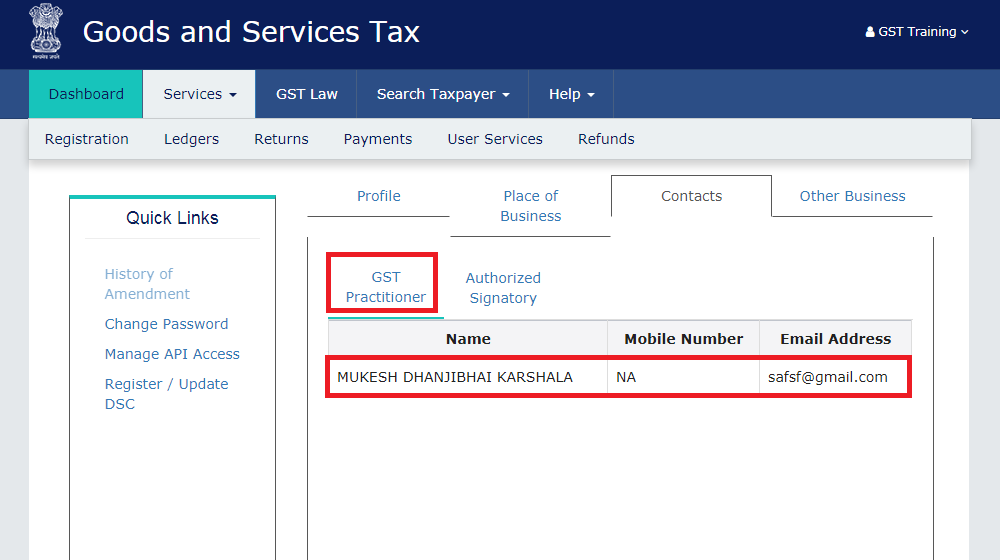

13. Once the GST Practitioner accepts the Taxpayer’s request, GSTP details will appear on the Taxpayer’s Profile page, under the Contacts section.

Notes:

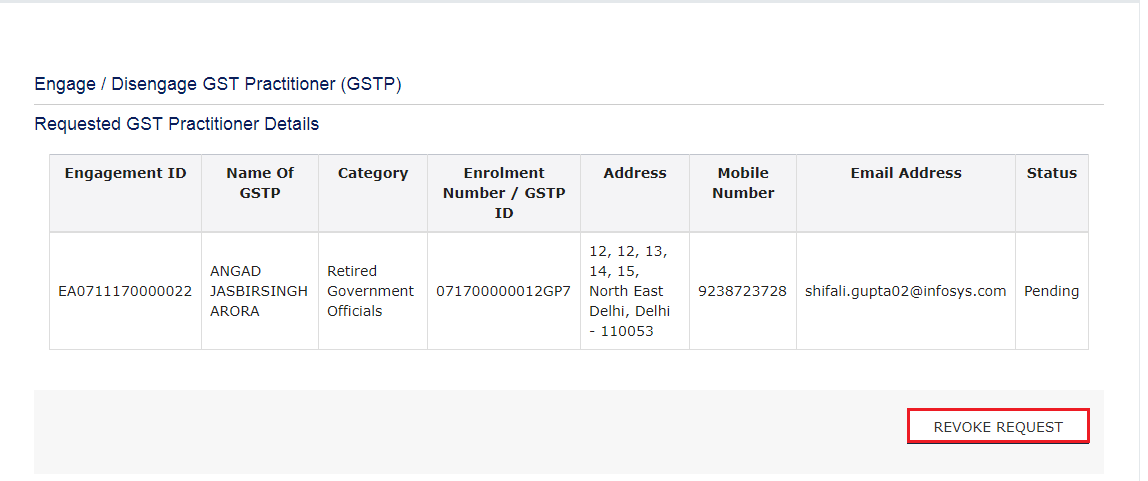

14. To revoke the engagement request, follow the below steps:

Engaging a GST practitioner on the GST portal is a seamless process, enhancing the taxpayer's compliance efficiency. Through a few simple steps, taxpayers can authorize practitioners to perform various tasks on their behalf, ensuring smooth tax management. The portal facilitates communication between taxpayers and practitioners, streamlining engagement and enhancing collaboration for effective GST compliance.

gst practitioner

gst portal india

gst practitioner eligibility

how to become gst practitioner

what is gst practitioner

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More