04-03-2024

On 31st July, 2023, CBIC issued Notification No. 28/2023-Central Tax. It was mentioned in the said notification that the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act, 2023 shall come into force w.e.f. 01st of October, 2023.

Also, it specified that the provisions of sections 149 to 154 of the said Act shall come into force w.e.f. 01st of August, 2023.

To understand sections 137 to 139 of the Finance Act, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part I”.

To understand sections 140 to 146 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part II”.

To understand sections 147 to 156 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part III”.

To understand sections 157 to 159 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part IV”.

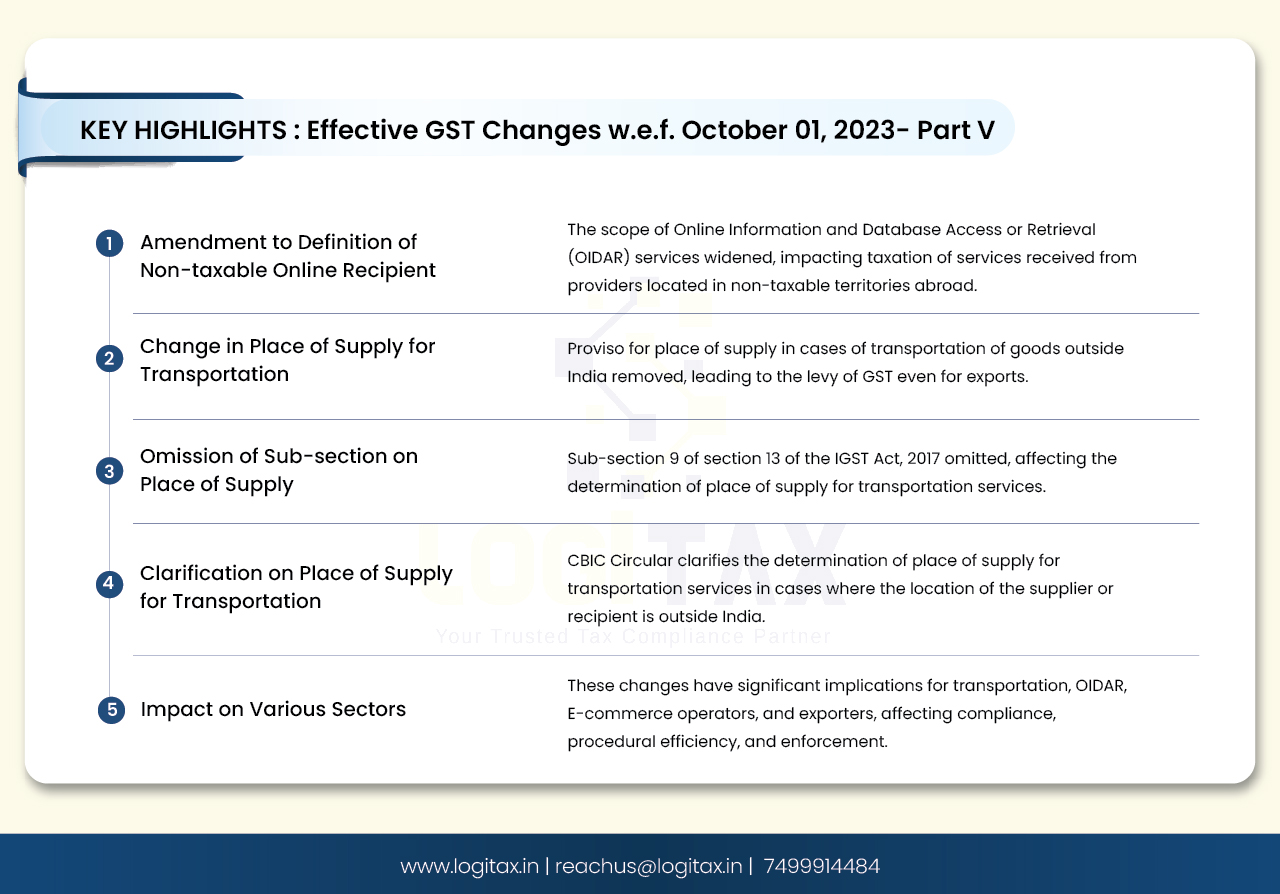

Lets discuss section 160 to 162 of the Finance Act, 2023 in this part!

Section 160 deals with amendments in section 2 of the IGST Act, 2017.

Section 2 of the IGST Act, 2017 covers definitions under IGST Act. Sub-section 16 covers the definition of a non-taxable online recipient.

Earlier, the definition of “non-taxable online recipient” was as follows:

"non-taxable online recipient" means any Government, local authority, governmental authority, an individual, or any other person not registered and receiving online information and database access or retrieval services for any purpose other than commerce, industry, or any other business or profession, located in taxable territory.

Explanation.--For this clause, the expression "governmental authority" means an authority or a board or any other body,--

(i) set up by an Act of Parliament or a State Legislature, or

(ii) established by any Government,

with ninety percent. or more participation by way of equity or control, to carry out any function entrusted to a Panchayat under article 243G or to a municipality under article 243W of the Constitution;"

Now, this definition is amended as follows:

"Non-taxable online recipient" means any unregistered person receiving online information and database access or retrieval services located in a taxable territory.

Explanation.-For the purposes of this clause, the expression "unregistered person" includes a person registered solely in terms of clause (vi) of section 24 of the Central Goods and Services Tax Act, 2017 (12 of 2017).

This amendment has widened the scope of Online Information and Database Access or Retrieval Services (OIDAR). Previously, services from OIDAR providers located in non-taxable territories abroad, when received by the central government, state government, government authorities, or individuals for non-business purposes, were exempt under GST. Now, they will also be taxed.

Section 162 deals with amendments in section 13 of the IGST Act, 2017.

Section 13 of the IGST Act, 2017 covers provisions related to the Place of supply of services where the location of the supplier or location recipient is outside India. Sub-section 9 is used to cover provisions related to the place of supply in the case of transportation of goods. It was read as follows:

“The place of supply of services of transportation of goods, other than by way of mail or courier, shall be the place of destination of such goods.”

This sub-section 9 is omitted w.e.f. 01-10-2023.

Also, CBIC has issued Circular No. 203/15/2023-GST which clarifies that after the said amendment to section 13(9) comes into effect i.e. 01.10.2023, the place of supply of services of transportation of goods, other than through mail and courier, in cases where the location of supplier of services or location of the recipient of services is outside India, will be determined by the default rule under section 13(2) of IGST Act, 2017. Accordingly, in cases where the location of the recipient of services is available, the place of supply of such services shall be the location of the recipient of services and in cases where the location of the recipient of services is not available in the ordinary course of business, the place of supply shall be the location of supplier of services. The same provisions will apply to transportation of goods by mail or courier.

It means, that if the exporter avails the service of transportation of goods outside India, he will have to pay GST on such services.

Numerous amendments in GST have come into effect as of October 1, 2023. These changes significantly impact the taxation landscape for various sectors, including transportation, Online Information and Database Access or Retrieval (OIDAR), and e-commerce operators. Also, various timelines and assessment procedures are updated to enhance procedural efficiency, compliance, and enforcement.

gst latest news

gst notifications

gst

gst amendment

gst portal

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More