On 31st July, 2023, CBIC issued Notification no. 28/2023-Central Tax. It was mentioned in the said notification that the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act, 2023 shall come into force w.e.f. 01st of October, 2023.

Also, it specified that the provisions of sections 149 to 154 of the said Act shall come into force w.e.f. 01st of August, 2023.

To understand sections 137 to 139 of the Finance Act, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part I”.

To understand sections 140 to 146 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part II”.

To understand sections 147 to 156 of the Finance Act, 2023, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part III”.

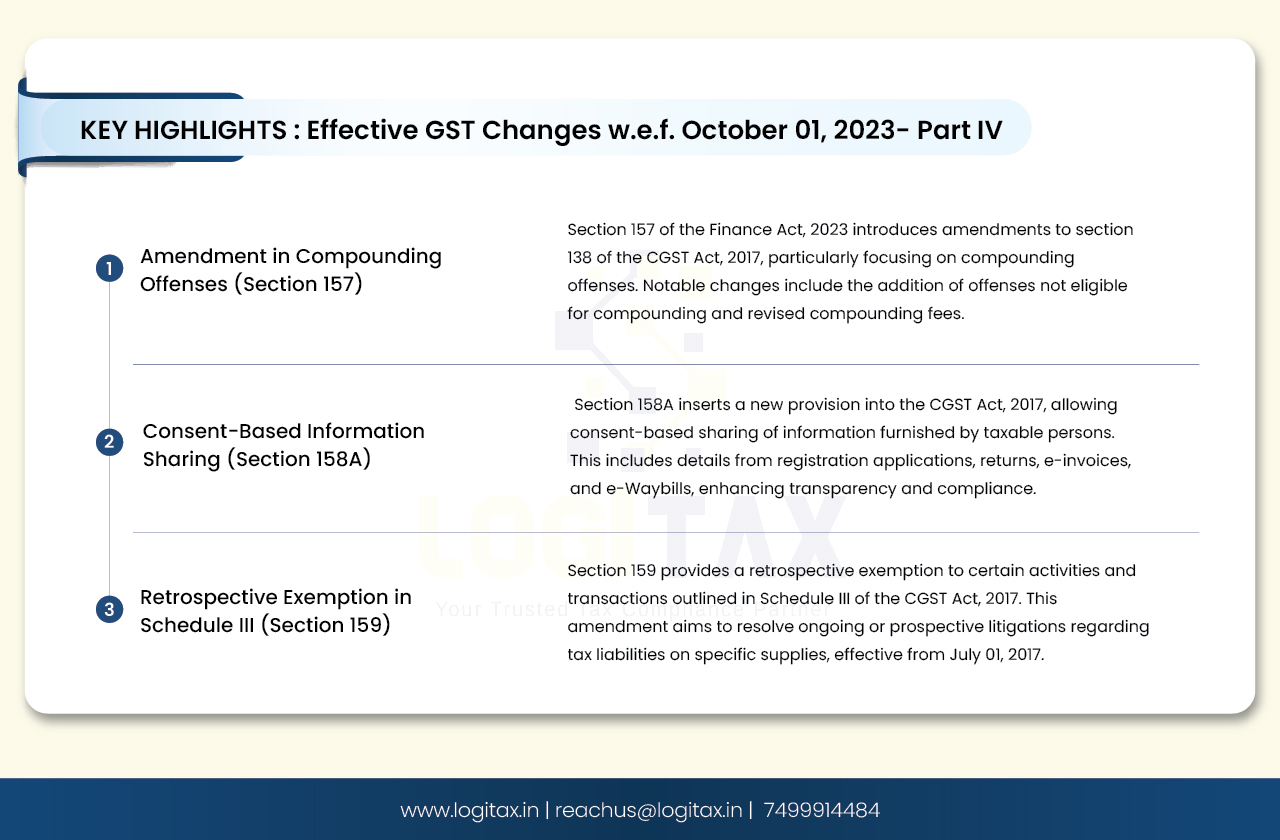

Let's discuss sections 157 to 159 of the Finance Act, 2023 in this part!

Section 157 deals with amendments in section 138 of the CGST Act, 2017.

Section 138 of the CGST Act, 2017 covers provisions related to the Compounding of offences.

Section 138(1) states that any offence under this Act may, either before or after the institution of prosecution, be compounded by the Commissioner on payment, by the person accused of the offence, to the Central Government or the State Government, as the case be, of such compounding amount in such manner as may be prescribed. However, it has a proviso that covers offenses not eligible for compounding.

This amendment adds clause (i) of section 132(1) to such list of offenses not eligible for compounding. This clause covers the offence of receiving or is in any way concerned with the supply of, or in any other manner deals with any supply of services which he knows or has reasons to believe are in contravention of any provisions of this Act or the rules made thereunder.

Further, it has made some other changes in the list of offenses not eligible for compounding.

Also, compounding fees are reduced as follows:

| Earlier | Now | |

|---|---|---|

| Minimum | Higher of INR 10,000 or 50% of the tax involved | 25% of the tax involved |

| Maximum | Higher of INR 30,000 or 150% of the tax involved | 100% of the tax involved |

Section 158 deals with the insertion of section 158A to the CGST Act, 2017.

Section 158A of the CGST Act, 2017 covers provisions related to the Consent based sharing of information furnished by taxable persons.

This section is as follows:

Consent-based sharing of information furnished by a taxable person 158A.

Section 159 deals with retrospective exemption to certain activities and transactions in Schedule III to the CGST Act, 2017.

It is stated in the amendment that in Schedule III to the Central Goods and Services Tax Act, paragraphs 7 and 8 and the Explanation 2 thereof (as inserted vide section 32 of Act 31 of 2018) shall be deemed to have been inserted therein with effect from the 1st day of July 2017.

Paragraph 7 of Schedule III covers the supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India.

Paragraph 8 of Schedule III covers the supply of warehoused goods to any person before clearance for home consumption.

Both these entries should have the effect of exemption from July 01, 2017. This is amended to put an end to ongoing litigations or prospective litigations in cases wherein no tax is paid by any taxpayer on these supplies.

However, no refund of such tax paid shall be available in cases where any tax has already been paid in respect of such transactions/ activities during the period from July 01, 2017, to January 31, 2019.

We have discussed amendments in section 138, 158A, and Schedule III of the CGST Act, 2017 in this part. Section 160 to 162 of the Finance Act will be covered in Part V of this blog named “Effective GST Changes w.e.f. October 01, 2023- Part V”. Stay tuned with LogiTax for such updates!

gst latest news

gst notifications

gst amendment

gst portal

gst india

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More