E-Invoice has been operational since October 2020 for taxpayers with Annual Aggregate Turnover (AATO) above Rs. 500 Crores and eventually, in a phased manner, e-invoice generation is made mandatory for taxpayers with AATO above Rs. 5 Crores. From day one, e-Invoice is seamlessly integrated with the e-Way bill system, and accordingly, e-Way bills are generated along with e-Invoice. That is, during e-invoice generation, if the transportation details are sent, the e-waybill is automatically generated. Most of the taxpayers are generating the e-invoice along with the e-way bill.

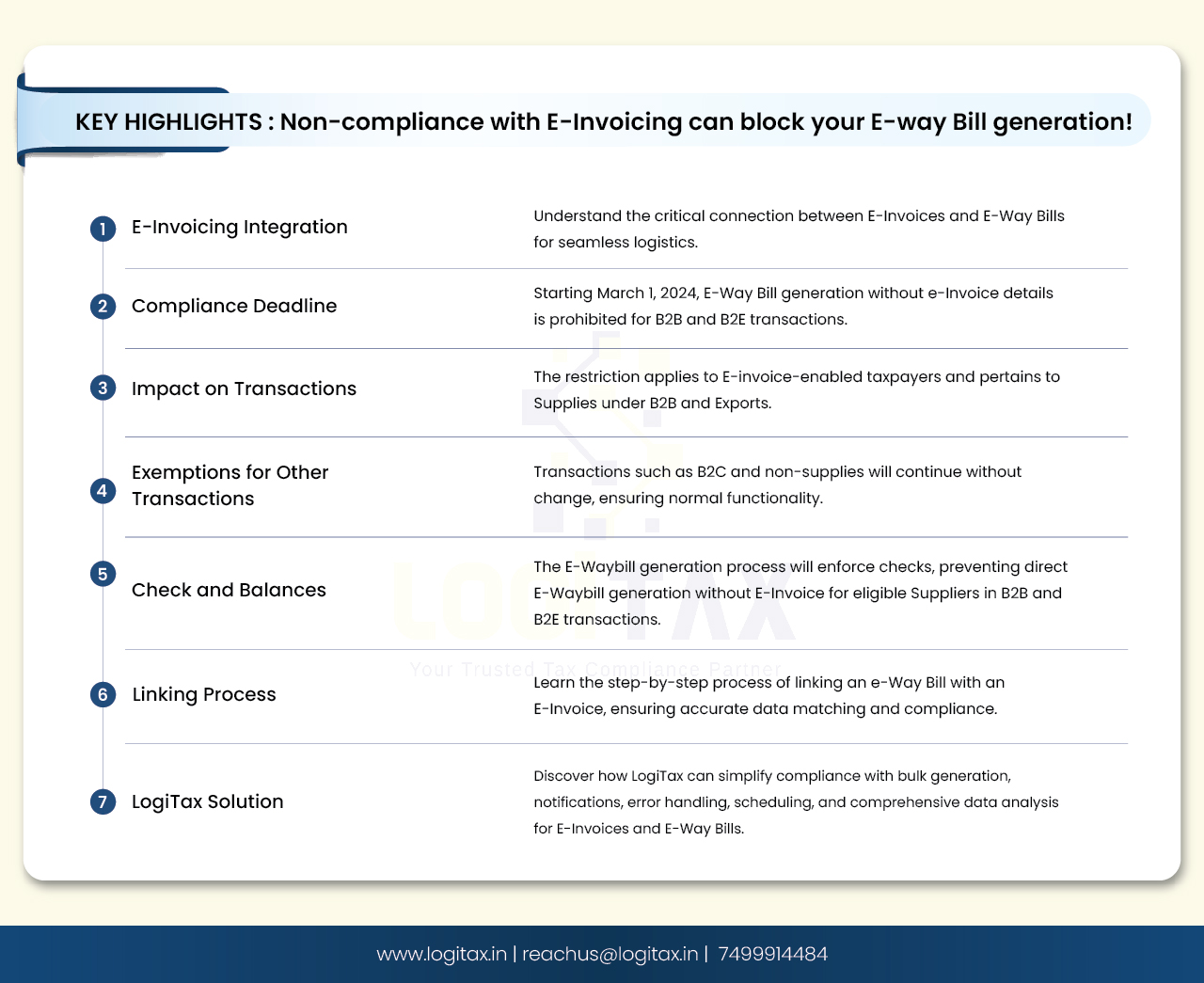

However, on analysis, the department found that some of the taxpayers, who are eligible for e-Invoicing, are generating E-Waybills without linking with e-Invoice for B2B and B2E transactions. In some of these cases, the invoice details entered separately under e-Waybill and e-Invoice do not match certain parameters. This is leading to a mismatch in the e-Waybill and e-Invoice statements.

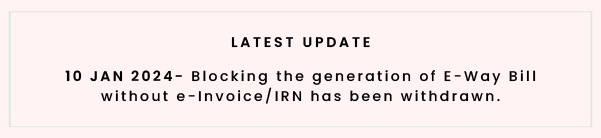

Hence, to avoid such situations, e-Waybill generation will not be allowed without e-Invoice details from 1st March 2024. National Informatics Centre has issued this update on 05th of January, 2024. This is applicable for e-invoice-enabled taxpayers and for the transactions related to Supplies under B2B and Exports. However, EWBs for other transactions such as B2C and non-supplies will function as usual without any change.

E-Waybill generation process will be incorporated with appropriate checks for taxpayers (Suppliers) eligible for e-invoicing. In the case of B2B and B2E (Exports), direct e-Waybill generation without e-Invoice will not be allowed for Suppliers eligible for e-invoicing. This applies to the E-Waybill categories of Supply/Exports/SKD/CKD/Lots.

However, e-Waybill generation for transactions related to B2C and other non-supplies will be allowed as usual. Similarly, for the E-Way Bills generated by the transporter, a similar check would be enforced on the Supplier GSTIN. Other operations such as Part-B updating, transporter ID updating, etc. will continue as usual without any change.

All taxpayers and transporters are requested to make necessary changes in their system so that they can adapt to the changes from 1st March 2024.

Connecting e-Invoices and e-Way bills aims to match data and improve oversight. Taxpayers should ensure that they have an updated system to ensure this compliance from 01st March 2024.

LogiTax software ensures Efficient management of E-Invoices and E-Way Bills. It automates processes, provides notifications, and data visualization dashboards, and generates comprehensive reports. Get started with the LogiTax E-Invoicing solution today for free!

e-way bill

einvoicing

e invoice generation

e way bill generation

compliance

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More