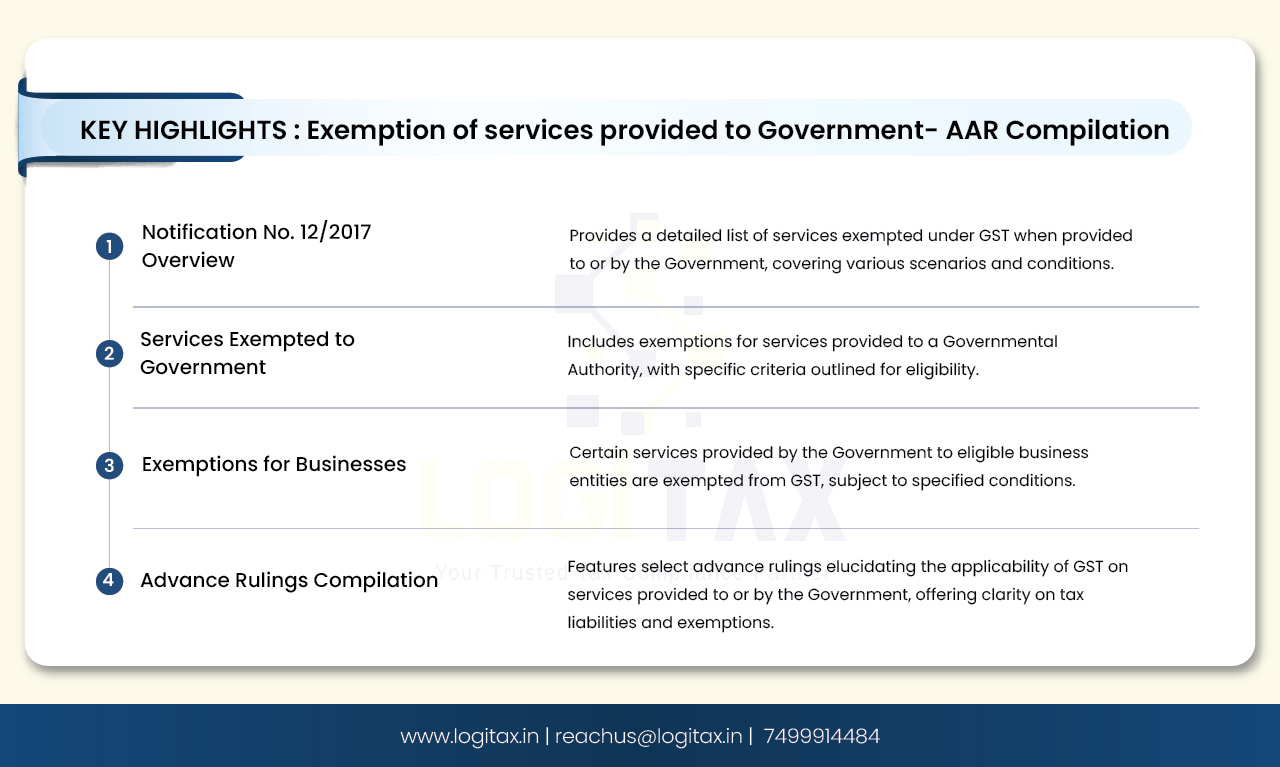

As per Notification No. 12/2017 - Central Tax (Rate), certain services provided to the Government are exempted under GST. Following is the list of services as mentioned in the said notification:

| Sr No. | Name of the applicant | Order Date | State | Ruling |

|---|---|---|---|---|

| 1. | REGIONAL AGRICULTURAL RESEARCH STATION PILICODE | 06/10/2023 | Kerala |

Applicability of GST on ticket charges collected as part of an exhibition collected by the Government Authority:

Applicant is eligible to claim exemption from payment of GST on ticket charges vide SI. No. 5 of Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017, as amended from time to time, subject to the condition that the services provided by the applicant on receipt of ticket charge shall be the activities about the functions enlisted under Article 243G of the Constitution. Otherwise, the activities are taxable at 18% GST. |

| 2. | NAVYA NUCHU | 09/02/2024 | Telangana |

Providing of property on rent to the Government:

The applicant is providing renting of buildings to GHMC and in municipalities and there is no direct relation between the services provided by the applicant and the functions discharged by the GHMC under Article 243W read with Schedule 12 to the Constitution of India. Therefore, these services do not qualify for exemption under Notification No. 12/2017. |

| 3. | ALL INDIA INSTITUTE OF MEDICAL SCIENCES | 08/02/2024 | Telangana |

Whether the applicant India Institute of Medical Sciences (AIIMS) is eligible to claim GST exemption on pure services such as Manpower services, Housekeeping services, and consultancy services received from vendors?

The Sl. No. 3 & 3A of Notification 12/2017-CT(Rate) as amended with effect from 01.01.2022 omitted the phrase 'Governmental Authority' from the description of the services. Hence the applicant is not eligible for exemption under entry 3 & 3A of Notification 12/2017-CT(Rate). |

| 4. | DREDGING AND DESILTATION COMPANY PRIVATE LIMITED | 20/12/2023 | West Bengal |

Whether Irrigation and Flood Control Department, Government of Delhi comes under the purview of Union Territory and instant supply be covered by Sl. No. 3A of Notification No. 12/2017- Central Tax (Rate) dated 28.06.2017?

The instant work falls within the ambit of matter listed at Sl. No. 6 of the Twelfth Schedule of 243W of the Constitution of India, i.e. "Public health sanitation conservancy and solid waste management". Supply of services being undertaken by the applicant for removal of the hump (silt/ earth/ manure/ sludge etc.) by dredging of the drain as awarded by the Irrigation and Flood Control Department, Government of Delhi shall be covered under Sl. No. 3A of Notification No. 12/2017- Central Tax (Rate) dated 28.06.2017 and therefore shall be exempted from GST. |

| 5. | RAGHUBALA CONSTRUCTION CO. | 01/09/2023 | Rajasthan |

Whether Urban Improvement Trust (UIT) Kota is a "Government Entity" and whether constructing a Community Hall by the applicant by the works contract allotted by UIT Kota is taxable under GST law.

UIT Kota was established by Govt. of Rajasthan under The Rajasthan Urban Improvement Act 1959 and it was established by Govt. of Rajasthan with 90% or more participation by way of equity or control to carry out a function entrusted by the State Government. Thus UIT, Kota falls under the category of "Government Entity". Applicant is liable to pay GST on supply of this service and there no exemption and deduction is available to applicant in respect of aforesaid service provided to UIT Kota. |

Taxpayers must scrutinize multiple advance rulings concerning this matter to firstly ascertain if the assessee aligns with the Government's definition, and secondly, whether its functions are enumerated in either Article 234W or 234G of the constitution.

exemption from gst

exempt supply under gst

IRP Portal

goods exempted from gst

GST

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More