The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Filing GST returns is a crucial aspect of regulatory adherence for businesses enrolled in the system.

Taxpayers may encounter various GST error codes during the multiple submissions, each signaling a distinct issue that necessitates resolution. Proficiency in decoding these error codes is indispensable for ensuring precise and punctual compliance.

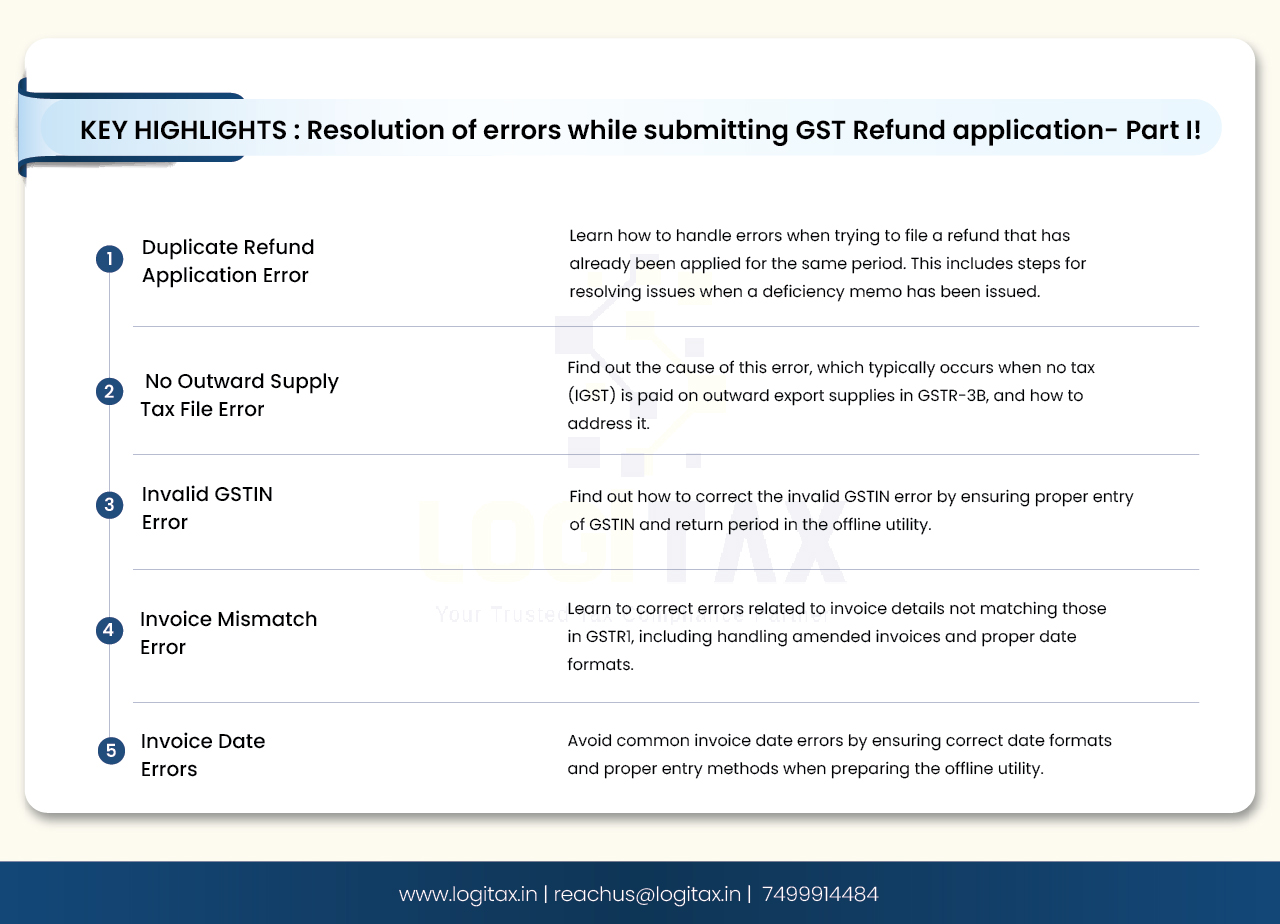

This blog decodes known errors while filing a GST refund application!

| Sr.No. | Error description | When does this issue/error occur? | Suggested solution |

|---|---|---|---|

| 1 | A refund has already been applied for this month. Kindly exclude | While filing a refund application, the following message pops up on the screen. | Once filed, the User can’t file a Refund for a category for the same period again. In such a case, please check if you have already filed an application for a refund under the same category for this period. In case, a deficiency Memo (RFD-03) has been issued by the officer, the user can file a fresh refund application covering the same period. However, if a person has inadvertently filed a NIL refund claim (RFD01A/RFD1) for a given period under a particular category, may again apply for a refund for the said period under the same category only if he satisfies the following two conditions:. 1. The registered person must have filed a NIL refund claim in FORM GST RFD01A/RFD-01 for a certain period under a particular category; and 2. No refund claims in FORM GST RFD-01A/RFD-01 must have been filed by the registered person under the same category for any subsequent period. It may be noted that condition (b) shall apply only for refund claims falling under the following categories: i. Refund of unutilized input tax credit (ITC) on account of exports without payment of tax; ii. Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax; iii. Refund of unutilized ITC on account of accumulation due to inverted tax structure; In all other cases, registered persons shall be allowed to re-apply even if condition (b) is not satisfied Registered persons satisfying the above conditions may file the refund claim under “Any Other” category instead of the category under which the NIL refund claim has already been file. For details refer to GST Circular No. 110/20/2019 dated 03/10/2019. |

| 2 | A draft saved/ submitted application already exists for the tax period | While creating a refund application, this message pops up at the screen | This means that a draft application is available under the saved application, which can be worked further for filing the application. You should check for the save application in path Services - > Refunds -> My saved/file application. If the application is in saved status, it may be filled up and filed. If it is in the submitted stage, you can proceed to file such an application. |

| 3 | No Outward Supply tax file for the selected return period | While creating a refund application, this message pops up on the screen. | It means no tax(IGST) is paid on the outward export supply (zero-rated supply) in GSTR-3B under the 3.1(b) column in Outward taxable supplies, for the period, for which the refund claim is being filed. |

| 4 | Kindly file a refund for periods… before filing … | While creating a refund application, this message pops up on the screen. | Please note that refund to file any refund application, you have to file a refund for previous return periods under the same refund type for which you are filing now. Refund applications are filed sequentially period-wise except when the refund is applied in the category (i) Excess cash balance in a ledger (ii) Tax paid wrongly/excess (iii) subsequent to any order/appeal/ finalization of provisional refund (iv) tax paid as interstate supply which is later held to be intra-state or vice versa (v) Refund applied in “any other category”. Hence, if you are applying for a refund in a category not mentioned above, you are requested to file for the mentioned periods or do NIL filing for the return period to which you don’t need to claim refunds. |

| 5 | Compile error in hidden module | Unable to Save/Submit/File a new refund application, this message pops up on the screen | Please do not try to click on the grey area or any other cell where user inputs are not required. If the error persists, download the fresh offline utility sheet and try again. |

| 6 | The cell or chart that you are trying to change is protected and therefore read-only. | Unable to Save/Submit/File a new refund application, this message pops up on the screen | Once this error appears then you should delete the existing sheet download the statement sheet and fill the data afresh. Try opening the utility with the latest version(Recommended: Version above 2007) of Microsoft Office and you will click Enable editing and enable content in offline utility on the top. Click the “Enable editing” and “Enable content button” in order to make it an editable file. |

| 7 | “Invalid GSTIN” when the user is trying to create an offline utility file to claim a Refund. | Unable to Save/Submit/File a new refund application, this message pops up at the screen. | Once the error appears then you should delete the existing sheet download the statement sheet and fill the data afresh. Try opening the utility with the latest version(Recommended: Version above 2007) of Microsoft Office, Enter 'GSTIN' and 'Return period'(format-"mmyyyy")in the adjacent column of the respective field only (that is column no. C) |

| 8 | Please enter either Integrated tax or (Central and State) tax value for inward supplies. | Unable to Save/Submit/File a new refund application, this message pops up on screen. | While preparing the offline utility, you should not enter ‘0’ in any columns either on Integrated tax Central tax, or State tax, leave it blank if you don’t have any value to enter. |

| 9 | Invoice not found in return...' OR 'Invoice value is not as per return…' OR 'Invoice type is not matching as per return… | Unable to Save/Submit/File new refund application, this message pops up at screen | While preparing from the offline Utility, you should provide Invoice details as per GSTR1, If Invoices are subsequently amended in GSTR 1, then in offline utility, you should give Invoice details (as amended) If you are copying Invoice details from another Excel sheet, Invoice date will implicitly convert to MM/DD/YYYY format. So User does not copy/paste dates directly. First copy/paste dates to notepad and then paste it in offline utility in the format dd-mm-yyyy . |

| 10 | Invoice date gets changed while validation offline utility...; OR “Invoice date cannot be before 01/July/2017" OR "Future date is not allowed" | Unable to Save/Submit/File new refund application, this message pops up at screen. | While preparing the offline Utility, you should provide Invoice details as per GSTR1. If you are copying Invoice details from another Excel, the Invoice date will implicitly convert to MM/DD/YYYY format. So you should not copy/paste dates directly. First copy/paste dates to notepad and then paste it in offline utility in the format dd-mm-yyyy. |

Filing GST refund applications can be challenging due to various error codes signaling specific issues. Understanding and resolving these errors is essential for timely and accurate compliance.

This blog detailed common errors in GST refund applications, such as duplicate refund filings, handling draft applications, and managing outward supply tax errors. It also covered solutions for issues with offline utility files and the necessary conditions for claiming refunds.

refund in gst

gst refund rules

how to claim gst refund

who can claim

gst refund process

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More