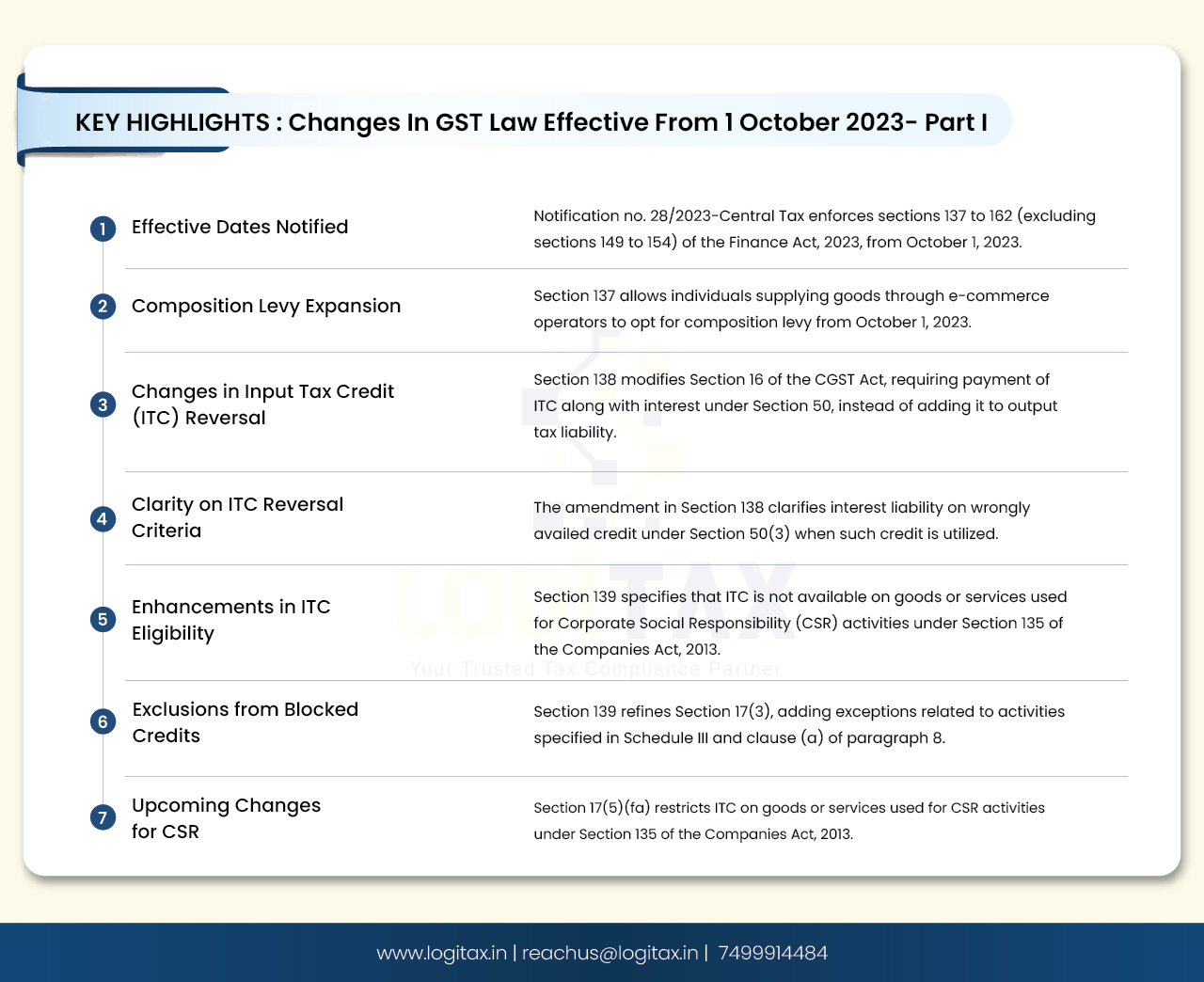

On 31st July, 2023, CBIC issued Notification no. 28/2023-Central Tax. It was mentioned in the said notification that the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act, 2023 shall come into force w.e.f. 01st of October, 2023.

Also, it specified that the provisions of sections 149 to 154 of the said Act shall come into force w.e.f. 01st of August, 2023.

Let's discuss section 137 to 139 of the Finance Act, 2023 in this part!

Section 137 deals with the following amendments in section 10 of the CGST Act, 2017:

(a) in sub-section (2), in clause (d), the words "goods or" shall be omitted;

(b) in sub-section (2A), in clause (c), the words "goods or" shall be omitted.

Section 138 deals with the following amendments in section 16 of the CGST Act, 2017.

Section 16 of the CGST Act deals with Eligibility and conditions for taking input tax credit.

Section 139 deals with following amendments in section 17 of the CGST Act, 2017.

Section 17 deals with Apportionment of credit and blocked credits.

It has following amendments:

This change will be in respect to para 8(a) of Schedule III of the CGST Act, which includes the supply of warehoused goods to any person before clearance for home consumption within the meaning of exempted supply for the purpose of reversal of common ITC under Section 17(2) and (3) read with Rule 42 and 43 of the CGST Rules. It means ITC will be reversed on supply of warehoused goods to any person before clearance for home consumption.

Goods suppliers through e-commerce can now opt for composition levy from October 1, 2023, as the term "goods" is omitted from Section 10(2) of the CGST Act, 2017. Changes in Section 16(2) alter the treatment of Input Tax Credit (ITC) reversal. The ITC amount is now required to be paid along with interest under Section 50, providing clarity on the process.

Section 17(5) is amended to exclude Input Tax Credit on goods or services used for Corporate Social Responsibility (CSR) activities as per Section 135 of the Companies Act, 2013. Stay updated for more insights on evolving GST regulations.

gst

gst portal

gst gov in

www gst gov in

goods and services tax

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More