LUT is Letter of Undertaking to be furnished in form GST RFD 11 under rule 96A, whereby the exporter declares that he/she would fulfil all the requirements prescribed under GST while exporting without making IGST payment.

Any registered person availing the option to supply goods or services for export /SEZs without payment of integrated tax has to furnish, prior to export/SEZs supply, a Letter of Undertaking (LUT), if he has not been prosecuted for tax evasion for an amount of Rs 2.5 Crore or above under the CGST Act/IGST Act/Existing law. Example of transactions for which LUT can be used are:

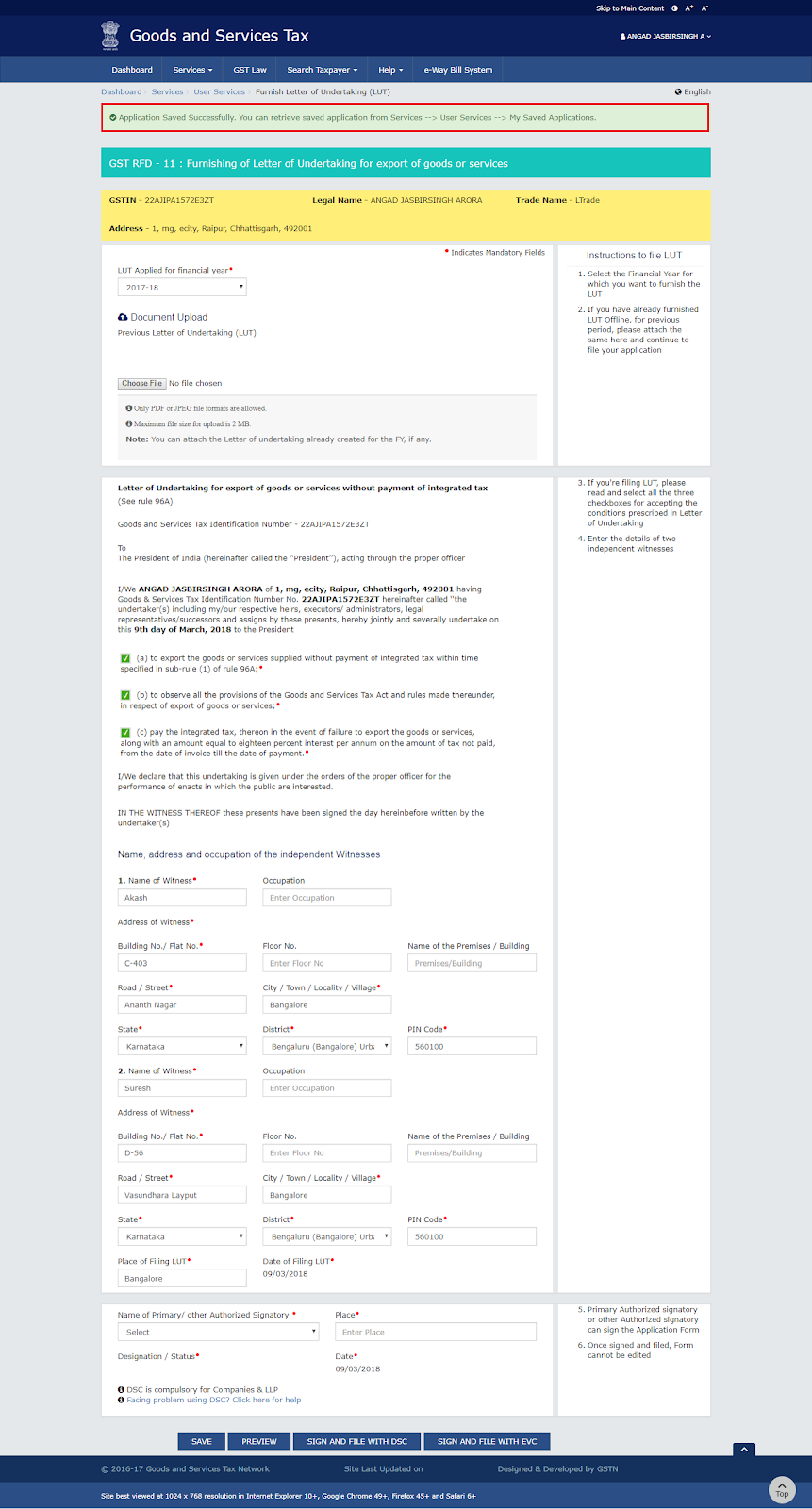

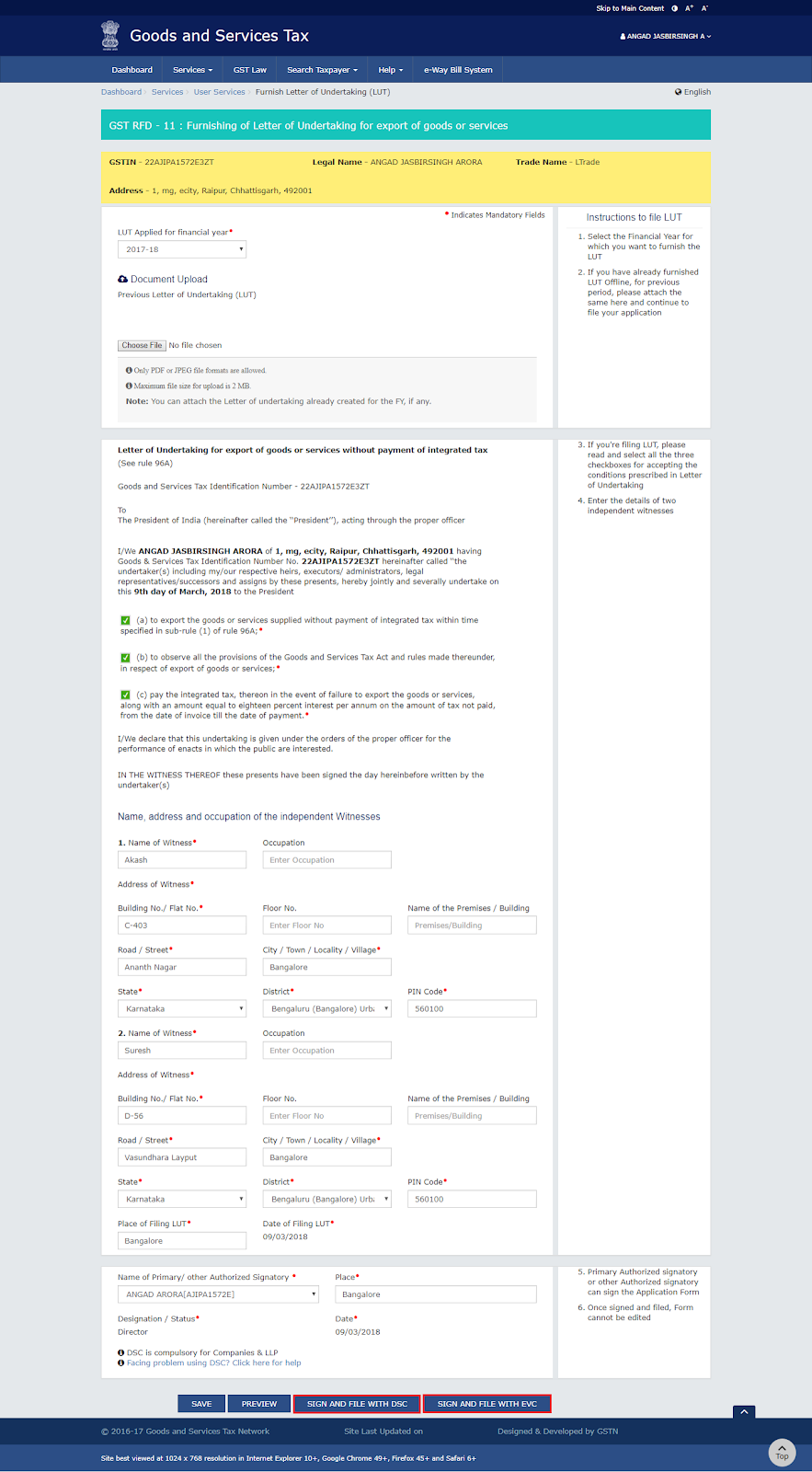

All registered taxpayers who have zero-rated supply of goods or services have to furnish LUT in Form GST RFD-11 on the GST Portal before affecting such supply. Access the GST portal and login using valid credentials. Navigate to Services > User Services > Furnish Letter of Undertaking (LUT) command to file LUT.

GSTIN and Name (Legal Name) of the Taxpayer would get prefilled based on login. Taxpayer needs to select the financial year for which LUT is being filed, enter the name, address and occupation details of two independent and reliable witnesses. Taxpayer also needs to select all the points of self-declaration before filing the LUT.

The validity of such LUT’s is for a period of one year (till the end of financial year). An exporter furnishing LUT’s is required to furnish fresh LUT for each financial year. If the conditions mentioned in LUT are not satisfied within the time-limit, the privileges are revoked and the exporter will have to furnish bonds.

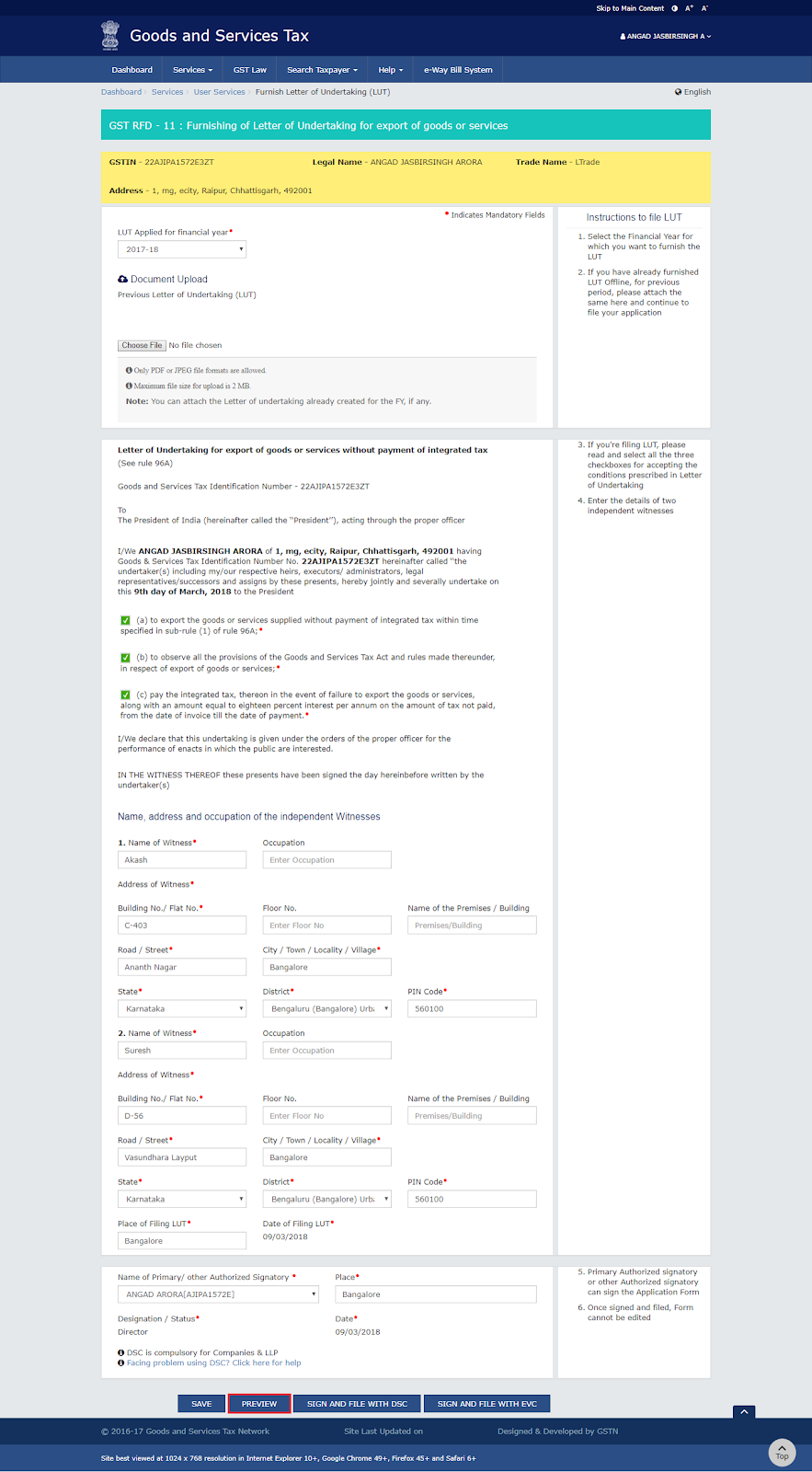

Primary authorized signatory/Any other Authorized Signatory needs to sign and file the verification with DSC/EVC. Authorized signatory can be the working partner, the managing director or the proprietor or by a person duly authorized by such working partner or Board of Directors of such company or proprietor to execute the form.

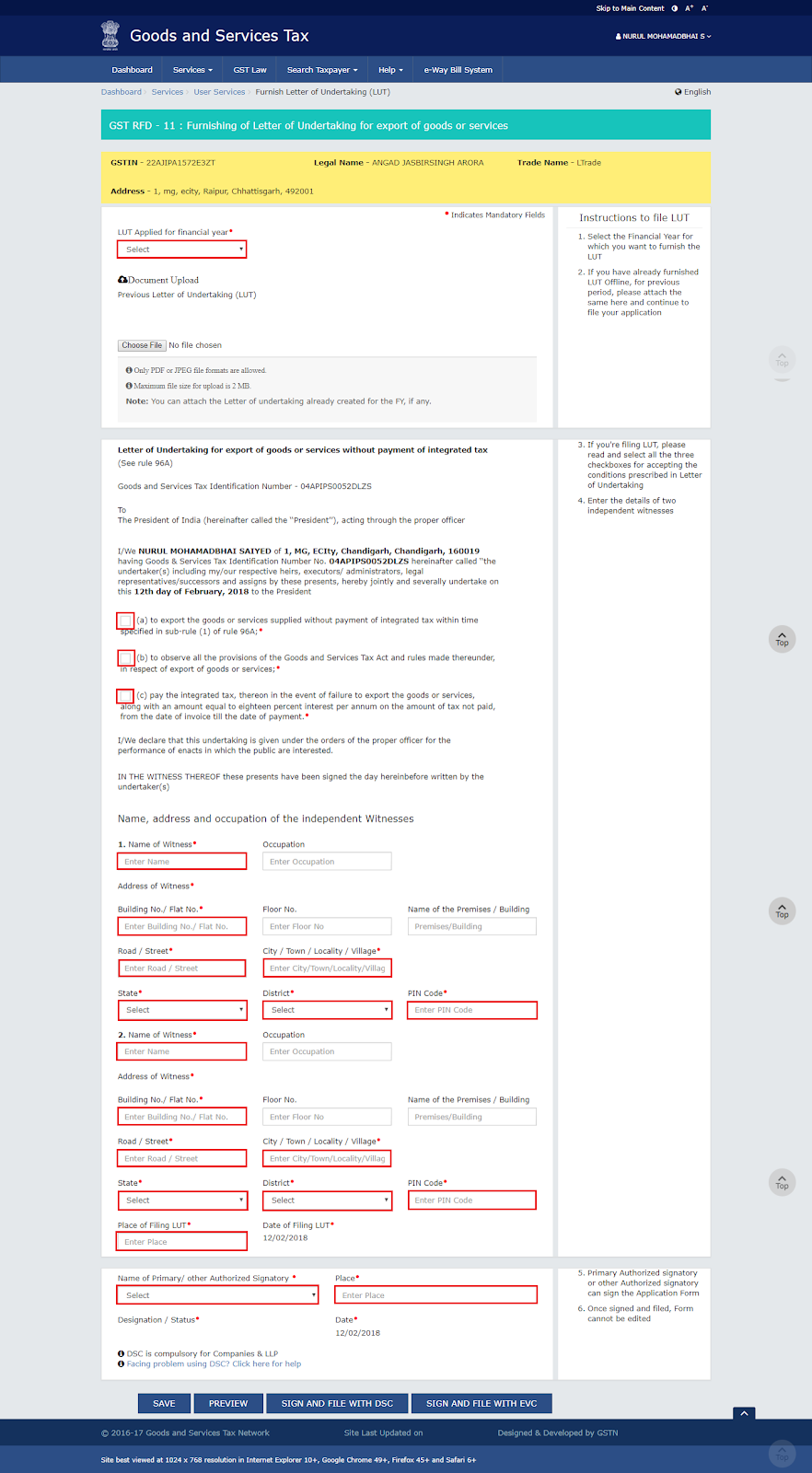

Go to www.gst.gov.in and login.

Click the Services > User Services > Furnish Letter of Undertaking (LUT) command.

Form GST RFD-11 is displayed. Select the financial year for which LUT is applied for from the LUT Applied for Financial Year drop-down list.

Click the Choose File button to upload the previous LUT.

Select the declaration checkboxes.

In the Name, Address and occupation of the independent and reliable witnesses section, enter the name and address of 2 witnesses.

In the Place of Filing LUT field, enter the place.

In the Name of Primary/ Other Authorized Signatory drop-down list, select the name of authorized signatory.

In the Place field, enter the place where the form is filed.

In case you want to save the form and retrieve the form later, click the SAVE button to save the form.

A confirmation message is displayed that application is saved successfully.

Note: You can navigate to Services > User Services > My Saved Applications to retrieve the saved application later.

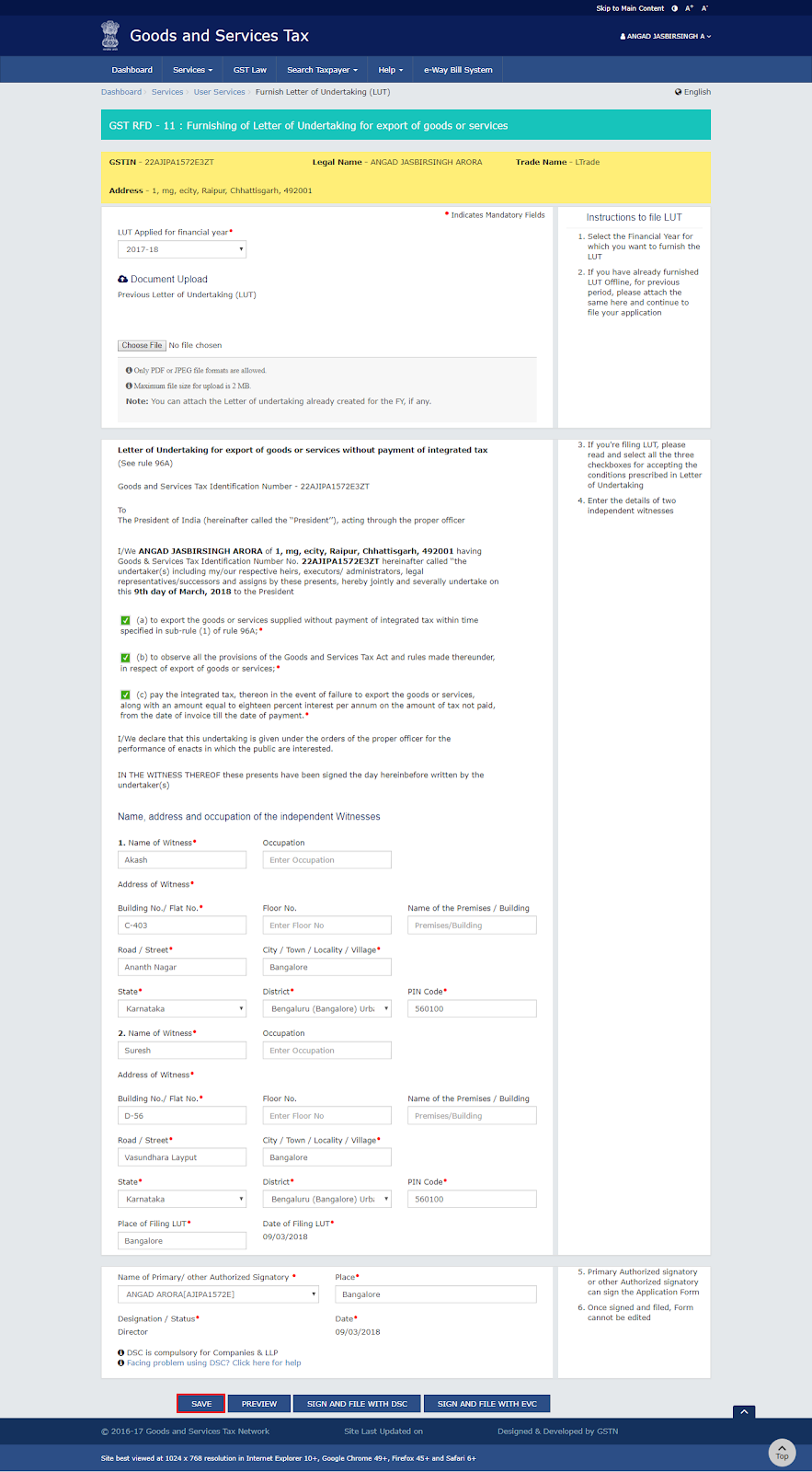

Click the PREVIEW button to preview the form.

The form is displayed in the PDF format.

Click the SIGN AND FILE WITH DSC or SIGN AND FILE WITH EVC button.

Note: If you have saved the form and retrieving it later, you need to select the name of authorized signatory and enter the place where the form is filed before filing the form.

Click the PROCEED button.

Note: You can click the DOWNLOAD button to download the acknowledgement.

In summary, the GST Letter of Undertaking (LUT) is essential for exporters availing zero-rated supply. The blog provides a concise guide on filing LUT, covering details, validity, and the application process. Compliance ensures uninterrupted export privileges, making the GST process smoother for exporters.

lut certificate

what is lut

what is lut in gst

lut for export

letter of undertaking gst

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More