19-10-2023

On October 19, 2023, the Central Board of Indirect Taxes and Customs (CBIC) issued nine notifications related to Central Goods and Services Tax (CGST) rates. These notifications introduce several changes that affect businesses and taxpayers. Know about the Changes in GST effective from 1st October 2023. Here's a simplified summary of these amendments:

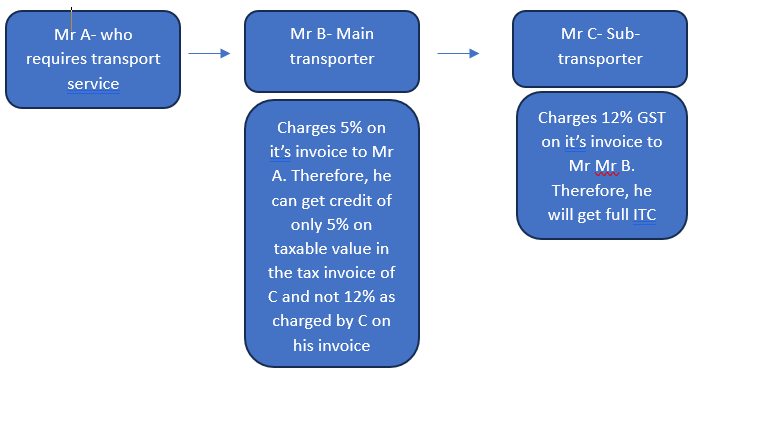

For Rent-a-Cab services, taxpayers can now choose to charge either 5% GST without Input Tax Credit (ITC) or 12% with ITC. It's important to note that in cases where a person opts for 5% GST but avails services from another person in the same business line as a subcontractor who charges 12% GST, ITC has been limited to 5% only.

Now, in such cases, ITC has been limited to 5% only. The following illustration is given in the notification:

Example- Imagine 'A' hires 'B' for a cab ride from New Delhi to Jaipur for Rs. 1000. Now, 'B' needs a cab with a driver, so 'B' rents one from 'C' for Rs. 800. 'C' charges 'B' a central tax of 6%, which amounts to Rs. 48.

If 'B' decides to charge 'A' a central tax of 2.5%, he can only claim an input tax credit on the service he got from 'C' to the extent of Rs. 20 (which is 2.5% of the Rs. 800), not the full Rs. 48.

This notification exempts certain services provided to "Government Authorities" from GST. The exempted services include water supply, public health, sanitation conservancy, solid waste management, and slum improvement and upgradation. Services provided by Indian Railways are now taxable, whereas certain services were previously exempt.

All services provided by Indian Railways are made chargeable under forward charge.

This notification clarifies that refunds under the inverted duty structure can be denied only in the case of the construction of a complex, building, or a part thereof. Refunds cannot be denied for other works contracts such as infrastructure projects and other constructions.

From January 1, 2022, the liability to pay GST on bus transportation services supplied through Electronic Commerce Operators (ECOs) has been placed on the ECOs under section 9(5) of CGST Act, 2017. The purpose of this provision was to relieve small-size bus operators from the compliance burden. However, bus operators organized as companies are excluded from this provision and should collect GST on their own. This would enable them to pay GST on their supplies using their ITC.

This notification prescribes the GST rate on "Food preparation of millet flour in powder form, containing at least 70% millets by weight" as 5% if sold in pre-packaged and labeled form. It also reduces the GST rate on molasses from 28% to 5% and specifies a GST rate of 18% on spirits for industrial use.

The GST rate on "Food preparation of millet flour in powder form, containing at least 70% millets by weight" is set at 0% if sold in other than pre-packaged and labeled form.

This notification specifies that the supply of "Used vehicles, seized and confiscated goods, old and used goods, waste, and scrap" by railways shall be under the forward charge mechanism.

No refund of the unutilized input tax credit shall be allowed when the credit has accumulated due to the tax rate on inputs being higher than the tax rate on the output supplies of such goods (other than nil-rated or fully exempt supplies). This rule applies specifically to "Imitation zari thread or yarn made out of Metallised polyester film/plastic film.

For further insights and detailed information on Council meetings, refer to Key Highlights of the 52nd GST Council meeting.

In conclusion, staying informed about these GST rate notifications is crucial for businesses. Adhering to these amendments is essential to maintain compliance with the evolving GST landscape. Advanced GST compliance solutions like LogiTax can assist in navigating these changes effectively. LogiTax streamlines the process, simplifies returns and reconciliation, and ensures compliance with GST regulations, making it a valuable resource for businesses.

Latest gst updates 2023

alt=Latest gst notification 2023

Latest gst notifications and circulars

Gst latest notifications

Gst notification 2023

Gst notification 10/2023

Gst rate change notification

Gst rate change notification latest

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More