The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Filing GST returns is a crucial aspect of regulatory adherence for businesses enrolled in the system.

Taxpayers may encounter various GST error codes during the various submissions, each signaling a distinct issue necessitating resolution. Proficiency in decoding these error codes is indispensable for ensuring precise and punctual compliance.

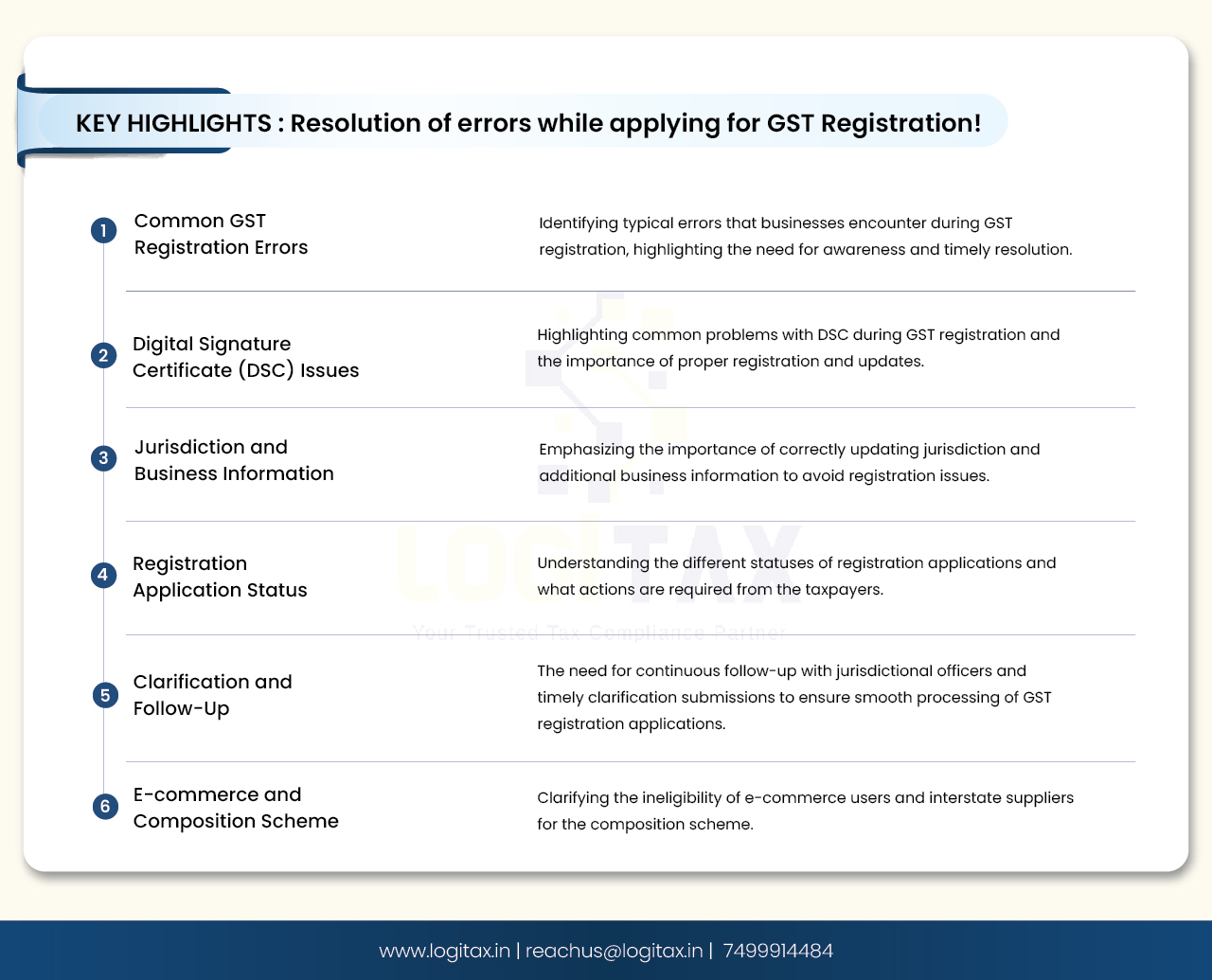

In this blog, known errors while filing the GST registration form are decoded!

| Sr.No. | Error description | When does this issue/error occur? | Suggested solution |

|---|---|---|---|

| 1 | The status of ARN generated against new registration is showing 'Pending for Clarification’. | When SCN has been issued. | Please note that SCN (Show Cause Notice) has been issued by the tax official against your application for registration. Kindly review and submit the desired information which is stated in the respective notice. |

| 2 | A system Error occurred while trying to submit an application through DSC. | At the time of submission. | You are advised to Register/Update the DSC that you are using to sign the application. Kindly follow the below-mentioned path to know the tab of “Register / Update DSC”: Login through TRN > Services > User Services > Register / Update DSC. |

| 3 | Updating Jurisdiction in application | While updating Jurisdiction | You are informed that Jurisdiction can be changed only when it has been assigned wrongly. In such a case, please contact your Jurisdictional Authority for changing the same. To search for contact details of the Jurisdictional Officer, please follow the below-mentioned path on the GST portal: Dashboard> Services> User Services > Contact. |

| 4 | Unable to add an additional place of business as the “ADD NEW” option is disabled. | While trying to add a new place of business. | In part B of the registration, please increase the “number of places” in the text box first, then the option to add additional places of business will become enabled. |

| 5 | E-commerce users or Inter State Suppliers cannot opt for a composition scheme. | At the time of applying for registration. | Persons making use of an e-commerce platform and/or making inter-state supply cannot opt for a composition scheme. (except supply of restaurant services over e-commerce platform) |

| 6 | Access was denied at the time of login. | At the time of login. | You are advised to check your registration status, without login, in the Search taxpayer bar. If it is showing as 'active' and you are still unable to log in, then raise a ticket. If the status is 'canceled’, then also raise a ticket. If the status is 'inactive', please contact your Jurisdictional Officer for clarification/guidance. In order to search for the contact details of the Jurisdictional Officer, please follow the below-mentioned path on the GST portal: Dashboard> Services> User Services > Contact. |

| 7 | Unable to download Order/SCN/New Registration RC/Amended RC or getting page not found. | At the time of downloading the order. | You are advised to download your registration certification from the GST portal. Post login go to Services> User Services > View/Download Certificates command. Upon approval of the registration application, registration certificate gets updated on the portal within 24 hours. If you are still unable to find your registration certificate, try again after clearing the cookies and history of the browser or change the browser. |

| 8 | GST Practitioner applications for registration show 105% profile complete. | When applying for registration. | This issue has been resolved and practitioners applying for fresh registration will not face this problem. However, if you are already registered and face this issue, please re-register at the GST portal. |

| 9 | Pending for processing | When tracking the registration application | This is in reference to your pending registration application. You are informed that the status against your submitted application is showing “Pending for Processing” which indicates that the application has been successfully filed and a decision on your application is pending with the concerned tax official. |

| 10 | Unable to file clarification as a page for filling clarification does not open and shows access denied. | When you are trying to file clarification for obtaining new registration. | You are requested to contact your Jurisdictional Officer and clarify the same against the clarification raised by the tax official. In order to search for the contact details of the Jurisdictional Officer, please follow the below-mentioned path on the GST portal: Dashboard> Services> User Services > Contact |

| 11 | When Applying for registration - Clarification filed - Pending for Order | When applying for New Registration | This implies that your application is pending with the respective tax officer for further action. In this regard, kindly note that it takes 7 working days from the end of the respective tax official to process your application further after submission of clarification. In case 7 working days have already passed, please contact your Jurisdictional officer and clarify the same. Note: Working days exclude all Gazetted holidays and weekends (Saturday and Sunday). In order to search for the contact details of the Jurisdictional Officer, please follow the below-mentioned path on the GST portal: Dashboard> Services> User Services > Contact. |

| 12 | The reason for Rejection is not known> | When the registration application has been rejected. | The application may have been rejected from the end of the Jurisdictional Officer due to certain inconsistencies in the details furnished while applying for the new registration. In order to seek clarification regarding the rejection of the submitted application for new registration, kindly follow the below mentioned steps: Log in with TRN > Services > User services > View Notices and orders. If you are unable to view the rejection reason, please contact your Jurisdictional officer. The system offers an option to search the details of Jurisdictional Officer using the path specified below Dashboard> Services> User Services > Contact Further, you can also file another application for new registration in order to make the desired changes in the registration details. |

Navigating the GST registration process can sometimes be challenging due to various potential errors and issues. Understanding these common errors and their solutions is crucial for ensuring a smooth and successful registration experience. By proactively addressing issues such as pending clarifications, DSC submission errors, and jurisdiction updates, taxpayers can avoid delays and ensure compliance with GST regulations. LogiTax provides comprehensive support to help businesses decode and resolve these issues efficiently.

gst registration online

gst limit for registration

gst registration process

gst apply

gst new registration

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More